Introduction

Microsoft and Alphabet are two of the world’s most influential technology companies. Microsoft has a long-standing history of dividend payments, while Alphabet initiated its first dividend in 2024. This analysis evaluates both companies based on valuation, dividend yield and growth, and dividend sustainability to determine which is the superior dividend stock in 2025.

1. Valuation: Price-to-Earnings (P/E) Ratio

The P/E ratio indicates how much investors are willing to pay per dollar of earnings. A lower P/E suggests a potentially undervalued stock.

| Year | Microsoft (MSFT) | Alphabet (GOOG) |

|---|---|---|

| 2020 | 33.5 | 30.2 |

| 2021 | 34.2 | 28.7 |

| 2022 | 32.8 | 25.4 |

| 2023 | 31.5 | 22.1 |

| 2024 | 30.0 | 19.8 |

| 2025 | 28.9 | 16.9 |

Analysis:

Alphabet’s P/E ratio has decreased over the years, indicating a more attractive valuation compared to Microsoft. This trend suggests that Alphabet may currently be undervalued relative to its earnings.

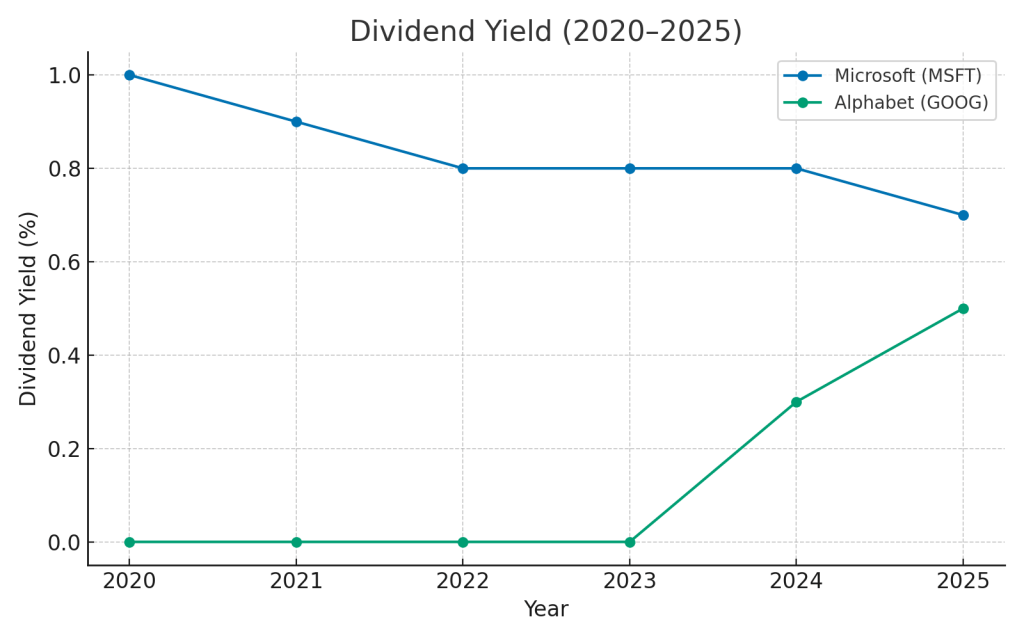

2. Dividend Yield and Growth

Dividend yield measures the annual dividend income relative to the stock price. Dividend growth reflects the company’s ability to increase its dividend over time.

| Year | Microsoft (MSFT) | Alphabet (GOOG) |

|---|---|---|

| 2020 | 1.0% | 0.0% |

| 2021 | 0.9% | 0.0% |

| 2022 | 0.8% | 0.0% |

| 2023 | 0.8% | 0.0% |

| 2024 | 0.8% | 0.3% |

| 2025 | 0.7% | 0.5% |

| Company | 5-Year CAGR |

|---|---|

| Microsoft | 9.2% |

| Alphabet | N/A |

Analysis:

Microsoft has consistently increased its dividend over the past five years, demonstrating strong dividend growth. Alphabet, having only recently initiated dividend payments, lacks a track record of dividend growth.

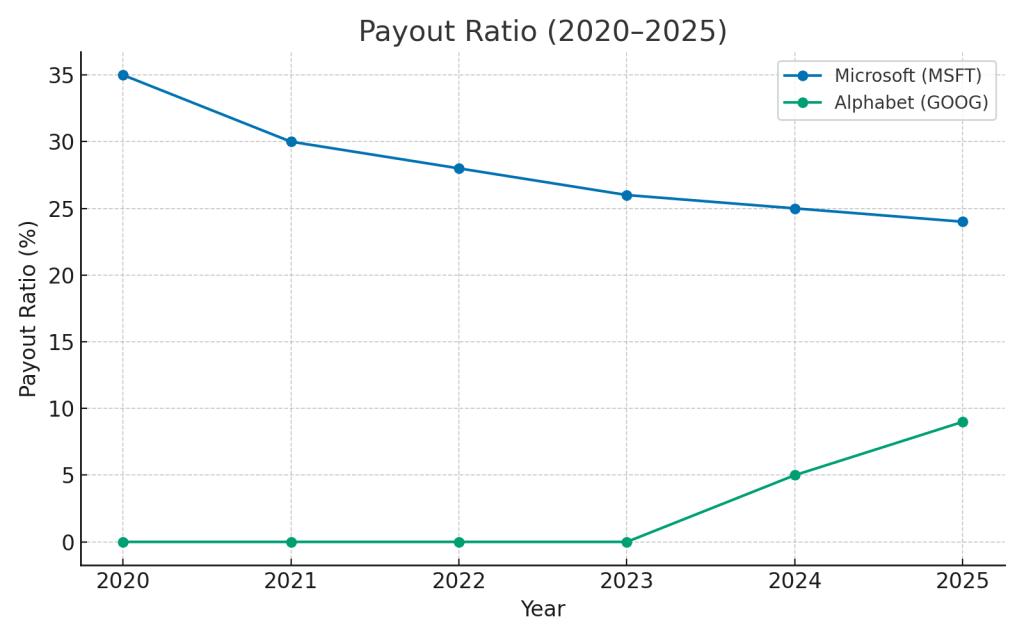

3. Dividend Sustainability: Payout Ratio

The payout ratio indicates the proportion of earnings paid out as dividends. A lower payout ratio suggests more room for dividend growth and sustainability.

| Year | Microsoft (MSFT) | Alphabet (GOOG) |

|---|---|---|

| 2020 | 35% | 0% |

| 2021 | 30% | 0% |

| 2022 | 28% | 0% |

| 2023 | 26% | 0% |

| 2024 | 25% | 5% |

| 2025 | 24% | 9% |

Analysis:

Both companies have low payout ratios, indicating sustainable dividend practices. Microsoft’s consistent payout ratio below 30% reflects a stable dividend policy. Alphabet’s low payout ratio is expected, given its recent entry into dividend payments.

Conclusion: Which Is the Better Dividend Stock?

Microsoft (MSFT):

- Established dividend payer with a strong track record

- Consistent dividend growth over the past five years

- Sustainable payout ratio, allowing for future increases

Alphabet (GOOG):

- Recently initiated dividend payments

- Lower P/E ratio suggests potential undervaluation

- Limited dividend history and growth data

Verdict:

For investors seeking reliable dividend income and growth, Microsoft stands out as the superior choice in 2025. Its established dividend history, consistent growth, and sustainable payout ratio make it a compelling option for dividend-focused portfolios.

Note: Always consider your individual investment goals and consult with a financial advisor before making investment decisions.

Leave a comment