Introduction

PepsiCo and Coca-Cola are two globally dominant beverage giants, known not only for their iconic brands but also for their consistency in paying dividends. For income-focused investors, both represent strong contenders. But which company stands out as the better dividend stock in 2025? In this article, we compare valuation, dividend yield and growth, and long-term sustainability of both companies.

1. Valuation: Are These Stocks Cheap or Expensive?

The Price-to-Earnings (P/E) ratio helps determine how a stock is valued relative to its earnings. A lower ratio typically signals a cheaper valuation.

| Year | PEP P/E | KO P/E |

|---|---|---|

| 2020 | 24.8 | 24.7 |

| 2021 | 25.1 | 24.4 |

| 2022 | 24.5 | 23.8 |

| 2023 | 24.3 | 23.3 |

| 2024 | 24.3 | 23.1 |

| 2025 | 24.0 | 22.9 |

Valuation Analysis:

Coca-Cola is currently trading at a lower P/E ratio than PepsiCo, suggesting it may be slightly undervalued relative to its earnings. Both companies remain within their 5-year average ranges, but Coca-Cola presents the better value opportunity at this time.

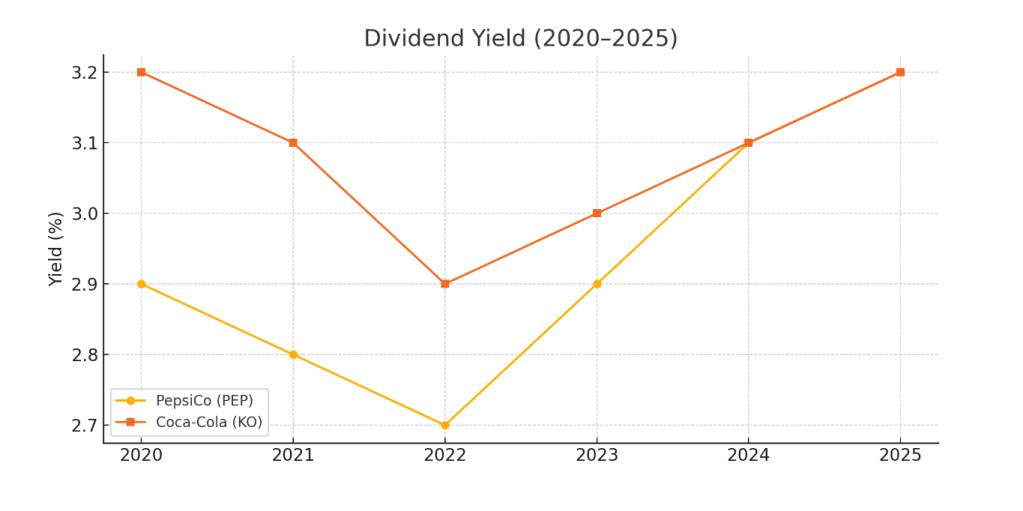

2. Dividend Yield and Growth: Who Pays More and Grows Faster?

Dividend yield provides an income snapshot, but long-term investors must also consider dividend growth over time.

| Year | PEP Yield | KO Yield |

|---|---|---|

| 2020 | 2.9% | 3.2% |

| 2021 | 2.8% | 3.1% |

| 2022 | 2.7% | 2.9% |

| 2023 | 2.9% | 3.0% |

| 2024 | 3.1% | 3.1% |

| 2025 | 3.2% | 3.2% |

| 6-Year Avg | 2.93% | 3.08% |

5-Year Dividend Growth (CAGR):

PEP: 7.1%

KO: 3.6%

Dividend Analysis:

While both stocks now yield 3.2%, Coca-Cola has had the slightly higher average over the last six years. However, PepsiCo clearly outpaces Coca-Cola in dividend growth, making it more appealing for investors focused on long-term income growth.

3. Dividend Sustainability: Are the Payouts Safe?

The payout ratio shows what percentage of earnings is returned to shareholders as dividends. A payout ratio below 80% is typically seen as healthy and sustainable.

| Year | PEP Payout | KO Payout |

|---|---|---|

| 2020 | 71% | 82% |

| 2021 | 68% | 79% |

| 2022 | 69% | 77% |

| 2023 | 70% | 78% |

| 2024 | 72% | 76% |

| 2025 | 71% | 75% |

Sustainability Analysis:

PepsiCo has consistently kept its payout ratio below the 80% threshold, showing discipline and sustainability. Coca-Cola has improved its payout ratio recently but still operates closer to the upper bound. PepsiCo offers slightly more headroom for future increases and is therefore safer from a dividend sustainability standpoint.

Conclusion: Which Dividend Stock Is the Better Buy?

Both PepsiCo and Coca-Cola meet the essential criteria for dividend investors: large market cap, stable yields, and a consistent dividend history. However, when examined side by side:

- Valuation: Coca-Cola is slightly cheaper.

- Dividend Yield: Coca-Cola has had a higher historical average, but both are equal now.

- Dividend Growth: PepsiCo leads clearly.

- Sustainability: PepsiCo maintains a more comfortable payout ratio.

Final Verdict:

PepsiCo (PEP) is the stronger dividend investment in 2025. Its higher dividend growth and safer payout ratio make it more attractive for long-term income investors—even if you pay a slight premium on valuation.

Note: Always consider your individual investment goals and consult with a financial advisor before making investment decisions.

Leave a comment