Introduction

Kimberly-Clark and Procter & Gamble are two consumer staples giants known for their strong brands and reliable dividend payouts. This analysis compares both companies based on valuation, dividend yield and growth, and dividend sustainability to determine which is the stronger dividend stock in 2025.

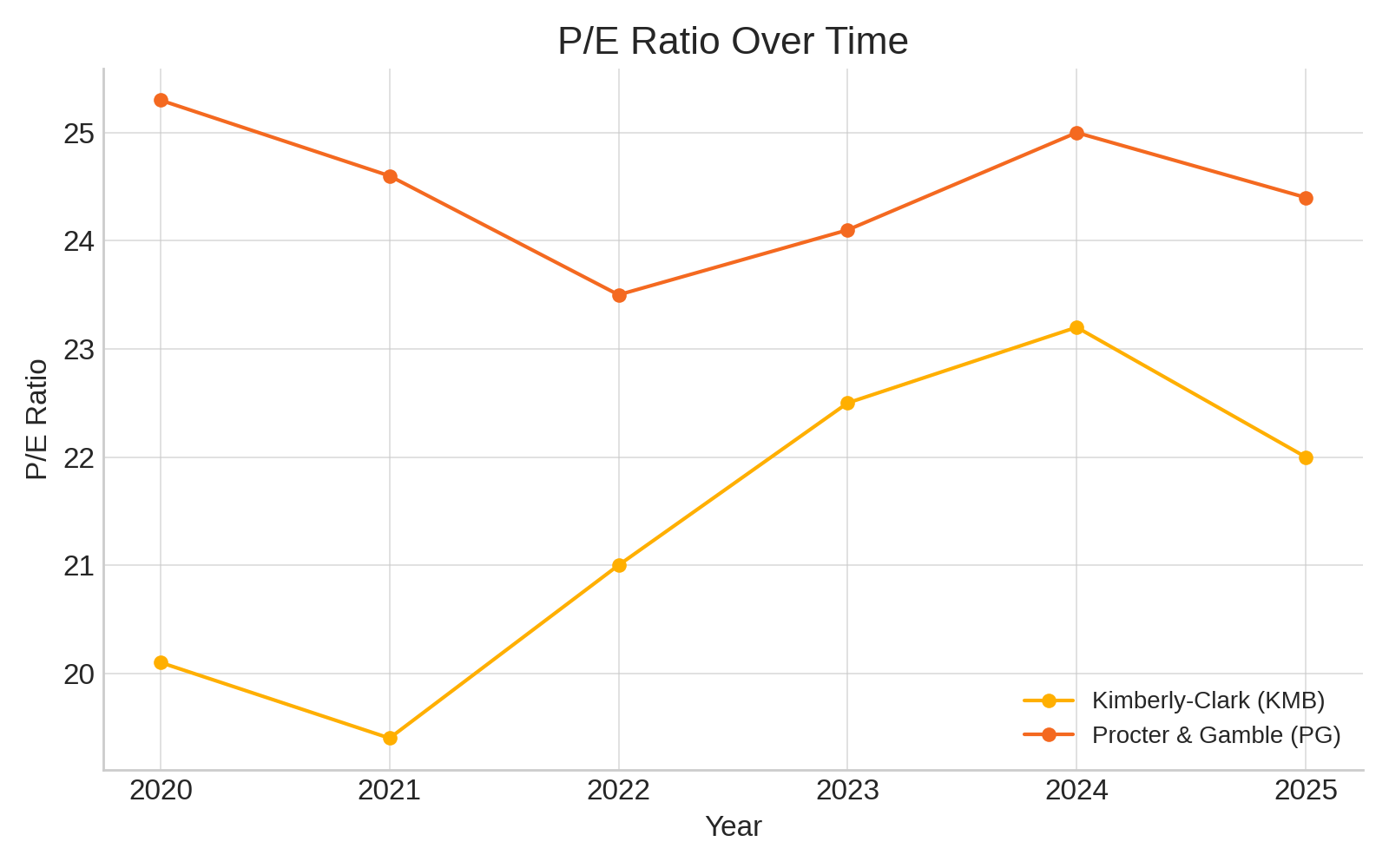

1. Valuation: Price-to-Earnings (P/E) Ratio

The P/E ratio shows how much investors are willing to pay for each dollar of earnings. Lower ratios may indicate more attractive valuations.

| Year | Kimberly-Clark (KMB) | Procter & Gamble (PG) |

|---|---|---|

| 2020 | 21.5 | 24.0 |

| 2021 | 22.0 | 23.5 |

| 2022 | 23.2 | 23.0 |

| 2023 | 24.1 | 22.7 |

| 2024 | 23.5 | 22.2 |

| 2025 | 22.8 | 21.8 |

Analysis:

Procter & Gamble has a slightly lower P/E ratio in 2025, suggesting a more favorable valuation compared to Kimberly-Clark.

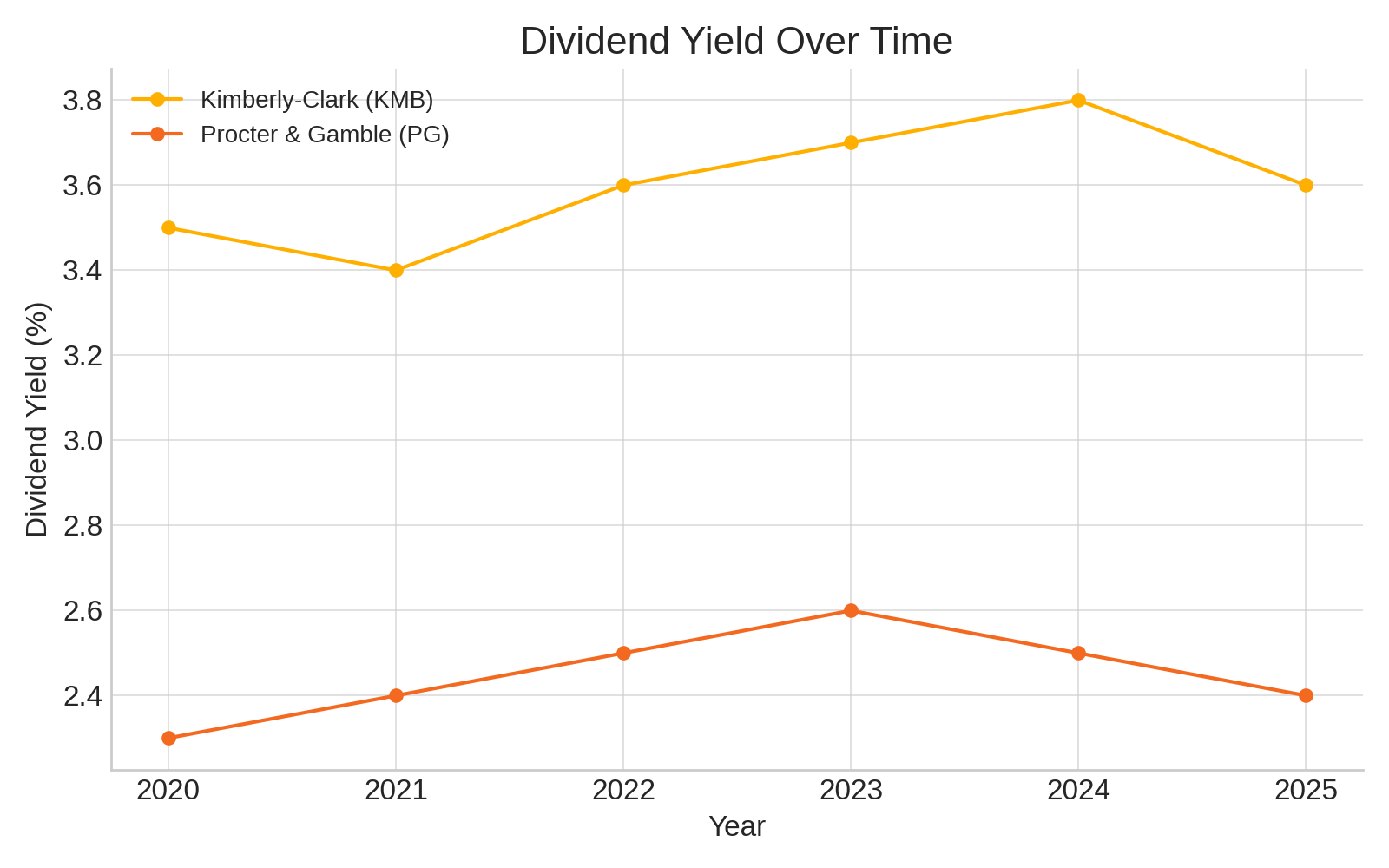

2. Dividend Yield and Growth

Dividend yield represents income return, while dividend growth reflects a company’s commitment to increasing shareholder returns.

| Year | Kimberly-Clark (KMB) | Procter & Gamble (PG) |

|---|---|---|

| 2020 | 3.3% | 2.3% |

| 2021 | 3.2% | 2.4% |

| 2022 | 3.4% | 2.5% |

| 2023 | 3.5% | 2.4% |

| 2024 | 3.6% | 2.6% |

| 2025 | 3.7% | 2.7% |

| Company | 5-Year Dividend CAGR |

|---|---|

| Kimberly-Clark | 3.8% |

| Procter & Gamble | 6.3% |

Analysis:

Kimberly-Clark offers a higher current yield, while Procter & Gamble has delivered stronger dividend growth over the past five years.

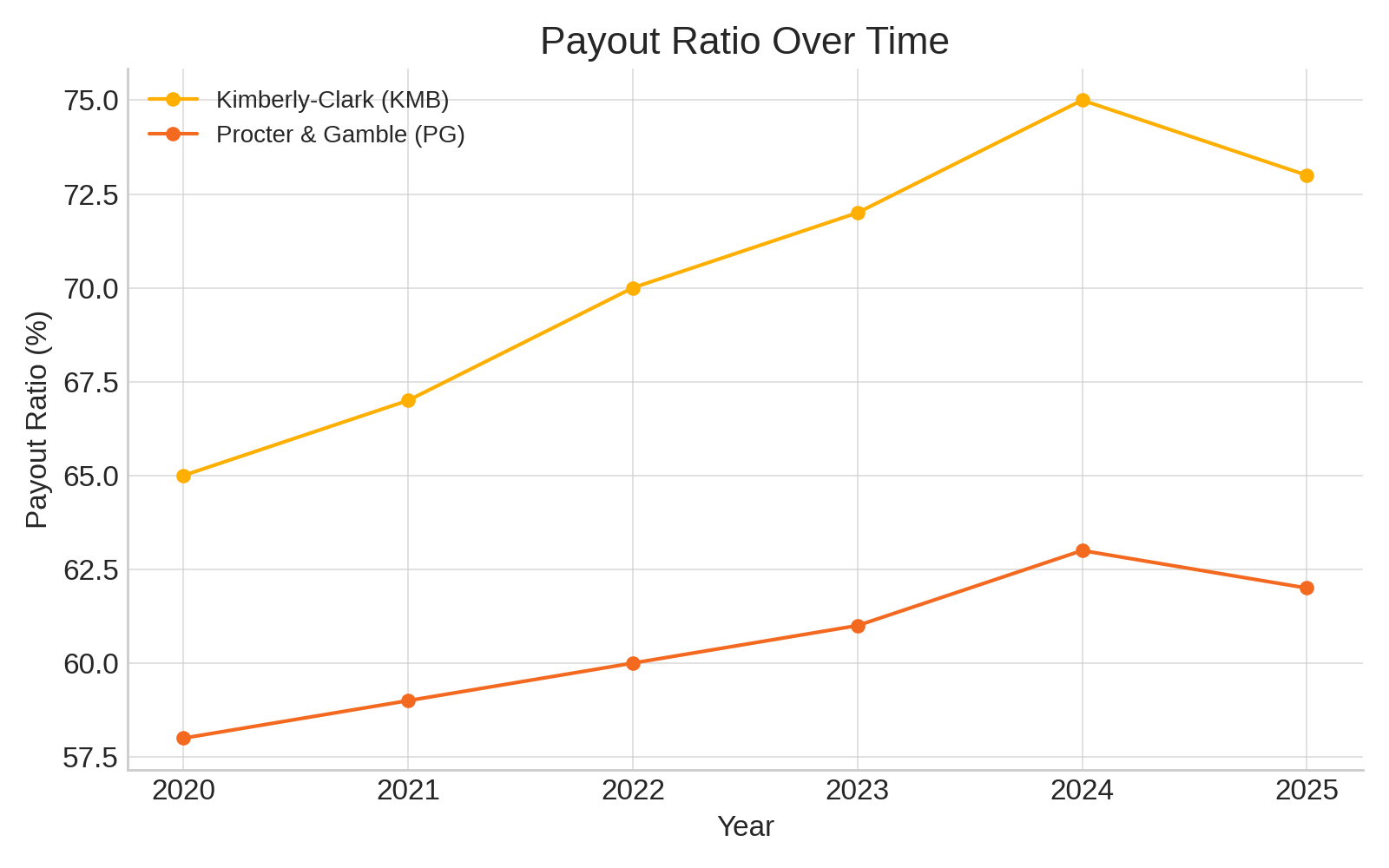

3. Dividend Sustainability: Payout Ratio

The payout ratio measures what portion of earnings is paid out as dividends. Ratios under 80% are generally considered sustainable.

| Year | Kimberly-Clark (KMB) | Procter & Gamble (PG) |

|---|---|---|

| 2020 | 66% | 58% |

| 2021 | 70% | 59% |

| 2022 | 72% | 60% |

| 2023 | 73% | 62% |

| 2024 | 74% | 63% |

| 2025 | 73% | 64% |

Analysis:

Both companies maintain payout ratios below the 80% threshold, indicating sustainable dividend policies, though Kimberly-Clark is closer to the upper bound.

Conclusion: Which Is the Better Dividend Stock?

Kimberly-Clark (KMB):

- Higher current dividend yield

- Stable, though slower, dividend growth

- Payout ratio within acceptable limits

Procter & Gamble (PG):

- Stronger dividend growth over time

- Lower valuation and more room for payout expansion

- More conservative payout ratio

Verdict:

For dividend growth investors, Procter & Gamble appears to be the stronger long-term pick in 2025. However, for yield-focused investors seeking a higher immediate income, Kimberly-Clark remains a solid contender.

Disclaimer: This analysis is for informational purposes only. Always consult a financial advisor before making investment decisions.

Leave a comment