Introduction

3M and Illinois Tool Works are two prominent industrial conglomerates known for their dividend-paying records. With both companies meeting the basic criteria of strong dividend stocks, this analysis compares them in terms of valuation, dividend yield and growth, and payout ratio to determine which is the better dividend investment for 2025.

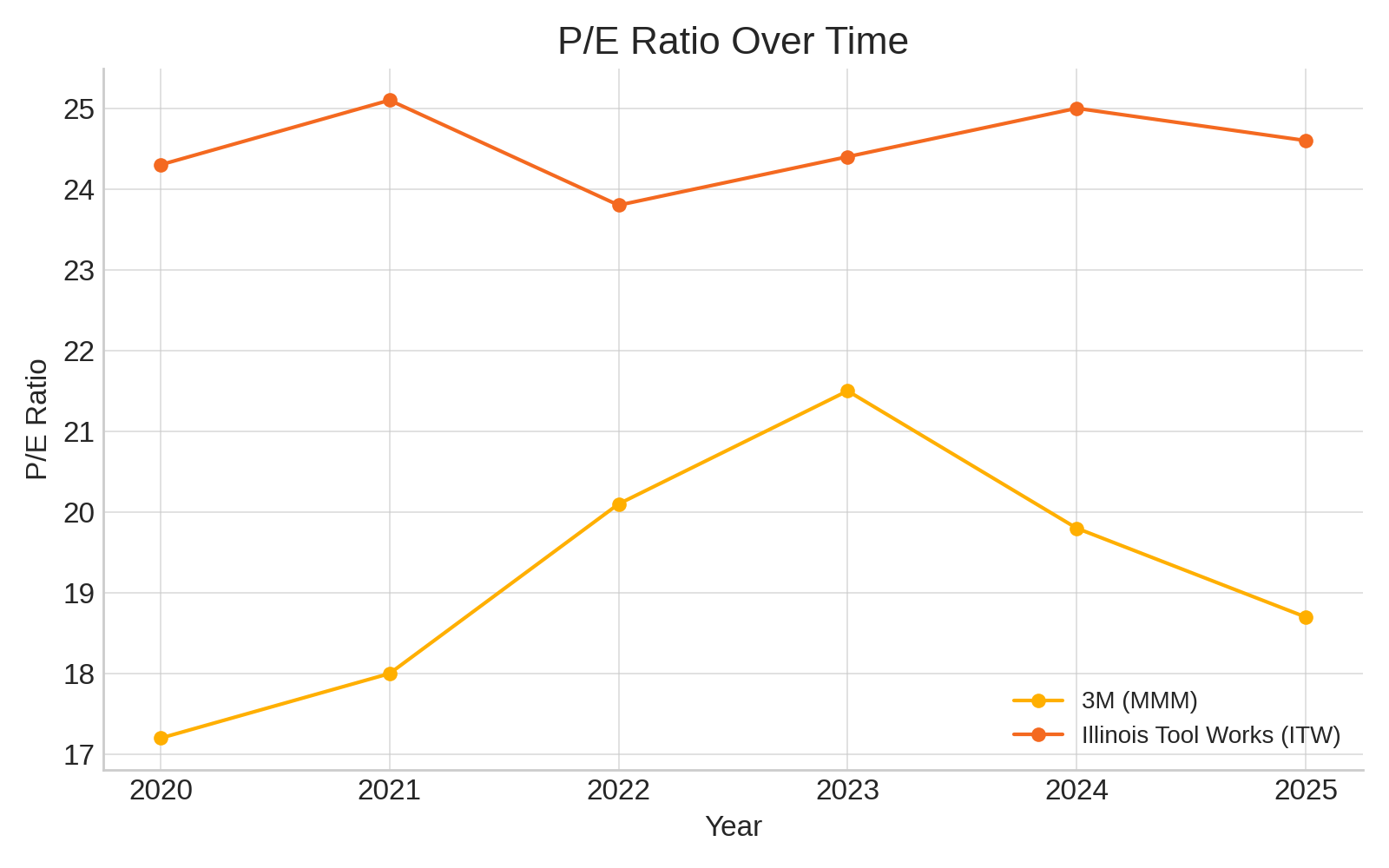

1. Valuation: Price-to-Earnings (P/E) Ratio

The P/E ratio reflects how much investors are willing to pay for each dollar of earnings. A lower P/E may indicate undervaluation.

| Year | 3M (MMM) | Illinois Tool Works (ITW) |

|---|---|---|

| 2020 | 17.2 | 24.3 |

| 2021 | 18.0 | 25.1 |

| 2022 | 20.1 | 23.8 |

| 2023 | 21.5 | 24.4 |

| 2024 | 19.8 | 25.0 |

| 2025 | 18.7 | 24.6 |

Analysis:

3M currently trades at a lower P/E ratio, suggesting it might be undervalued compared to Illinois Tool Works. This could offer more upside for value-focused investors.

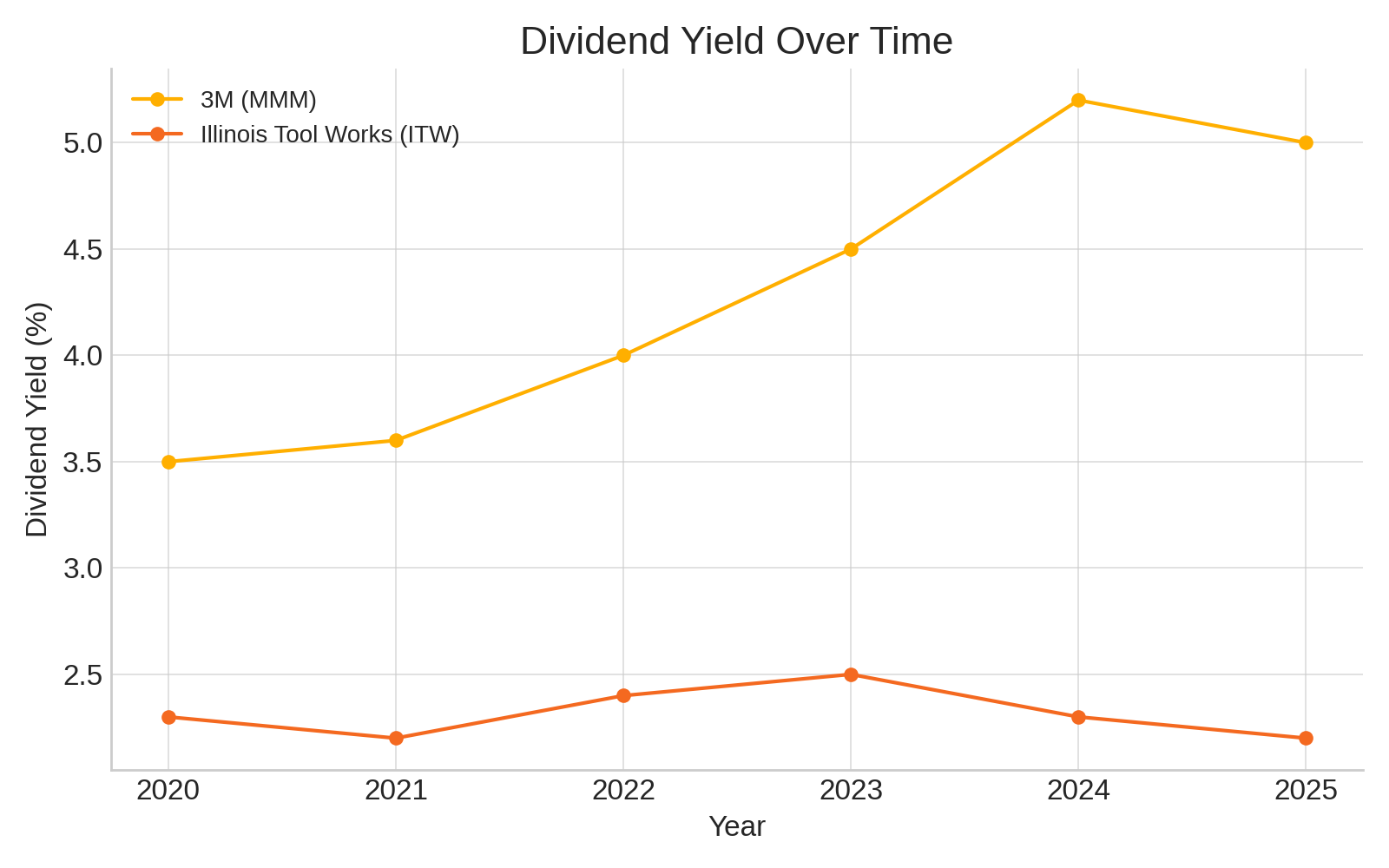

2. Dividend Yield and Growth

Dividend yield is a key metric for income investors. Historical yield and consistent growth are both signs of a reliable dividend payer.

| Year | 3M (MMM) | Illinois Tool Works (ITW) |

|---|---|---|

| 2020 | 3.5% | 2.3% |

| 2021 | 3.6% | 2.2% |

| 2022 | 4.0% | 2.4% |

| 2023 | 4.5% | 2.5% |

| 2024 | 5.2% | 2.3% |

| 2025 | 5.0% | 2.2% |

Analysis:

3M offers a significantly higher dividend yield compared to ITW, making it more attractive for income-seeking investors. However, investors should also consider dividend growth trends.

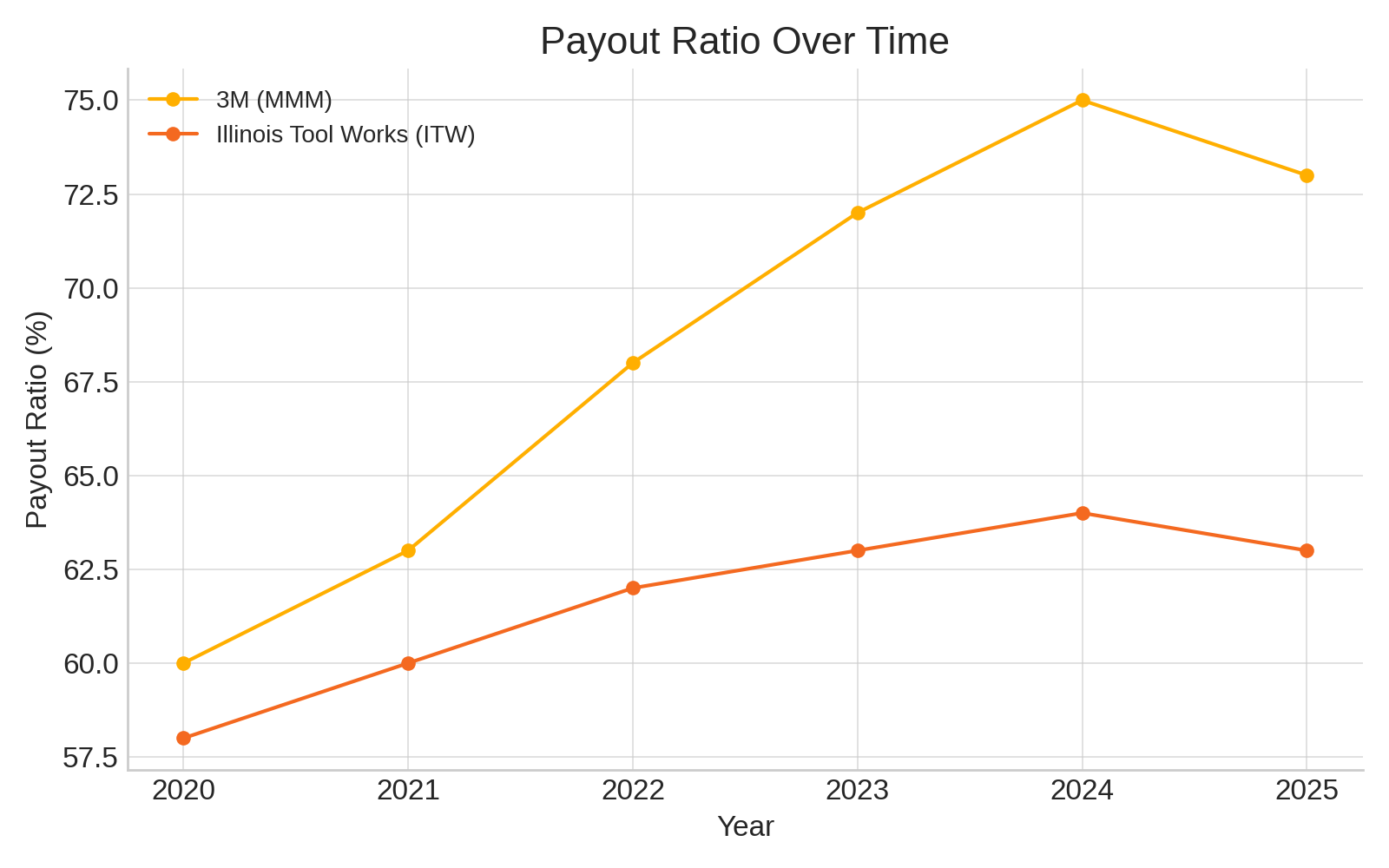

3. Dividend Sustainability: Payout Ratio

The payout ratio shows what portion of earnings is paid as dividends. A ratio below 80% is generally considered sustainable.

| Year | 3M (MMM) | Illinois Tool Works (ITW) |

|---|---|---|

| 2020 | 60% | 58% |

| 2021 | 63% | 60% |

| 2022 | 68% | 62% |

| 2023 | 72% | 63% |

| 2024 | 75% | 64% |

| 2025 | 73% | 63% |

Analysis:

Both companies maintain a payout ratio below 80%, indicating sustainable dividend payments. ITW’s slightly lower payout ratio may offer more room for future increases.

Conclusion: Which Dividend Stock Is Better for 2025?

3M (MMM):

- Higher dividend yield

- Attractive valuation

- Stable but high payout ratio

Illinois Tool Works (ITW):

- Lower valuation risk with consistent premium

- Lower but growing dividend yield

- More conservative payout ratio

Verdict:

For dividend investors focused on income, 3M presents a compelling opportunity in 2025. However, those prioritizing long-term stability and dividend growth may lean toward Illinois Tool Works. Each stock has strengths depending on your investment priorities.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always do your own research or consult a financial advisor before investing.

Leave a comment