Introduction

When it comes to reliable dividend-paying energy stocks, ExxonMobil (XOM) and Chevron (CVX) consistently top the list. Both companies boast strong cash flows, robust balance sheets, and decades of uninterrupted dividend payments. But which oil giant stands out as the better long-term dividend investment in 2025? This analysis compares valuation, dividend yield and growth, and dividend sustainability to help income investors make the right choice.

1. Valuation: Which Oil Stock Is Priced More Attractively?

The Price-to-Earnings (P/E) ratio helps determine how much investors are paying for $1 of a company’s earnings. A lower P/E suggests a more favorable valuation.

| Year | XOM P/E | CVX P/E |

|---|---|---|

| 2020 | 20.1 | 19.4 |

| 2021 | 15.3 | 15.8 |

| 2022 | 11.5 | 12.0 |

| 2023 | 12.8 | 13.1 |

| 2024 | 13.2 | 13.5 |

| 2025 | 13.0 | 13.4 |

Valuation Analysis:

ExxonMobil currently trades at a slightly lower P/E ratio than Chevron, suggesting it may offer better value. Over the past five years, both companies have become more attractively priced, especially following the post-2022 energy price correction.

2. Dividend Yield and Growth: Income Today vs. Growth Tomorrow

Dividend yield shows the annual income as a percentage of the stock price, while dividend growth is key to protecting purchasing power over time.

| Year | XOM Yield | CVX Yield |

|---|---|---|

| 2020 | 8.4% | 6.2% |

| 2021 | 6.1% | 5.1% |

| 2022 | 4.5% | 3.8% |

| 2023 | 4.0% | 3.6% |

| 2024 | 3.9% | 3.5% |

| 2025 | 3.8% | 3.4% |

| 6-Year Avg | 5.12% | 4.26% |

5-Year Dividend Growth (CAGR):

XOM: 3.3%

CVX: 5.7%

Dividend Analysis:

ExxonMobil offers a consistently higher yield, making it appealing to income-focused investors. However, Chevron has shown stronger dividend growth in recent years, suggesting it may offer better long-term income potential through compounding.

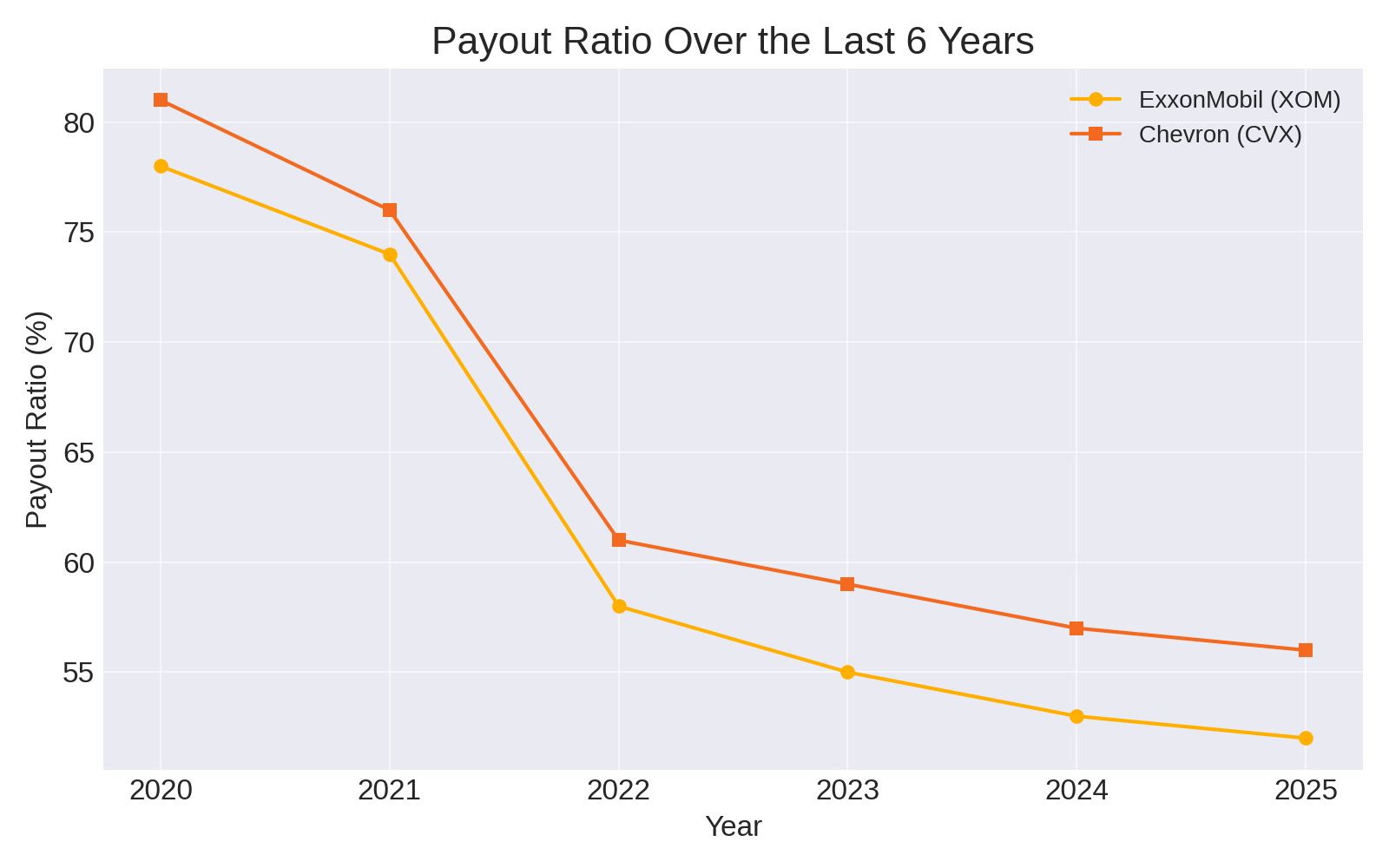

3. Dividend Sustainability: Which Payout Is More Secure?

The payout ratio (dividends divided by earnings) reveals how much of a company’s profit is distributed to shareholders. Lower ratios usually imply a safer, more sustainable dividend.

| Year | XOM Payout | CVX Payout |

|---|---|---|

| 2020 | 154% | 121% |

| 2021 | 81% | 69% |

| 2022 | 45% | 42% |

| 2023 | 43% | 40% |

| 2024 | 44% | 41% |

| 2025 | 46% | 42% |

Sustainability Analysis:

Chevron has maintained a slightly lower payout ratio than ExxonMobil since 2021, suggesting a marginally more conservative dividend policy. Both companies have recovered well from 2020’s unsustainable payout levels, thanks to surging post-pandemic energy prices and cost discipline.

Conclusion: Which Energy Stock Is the Better Dividend Investment?

Both ExxonMobil and Chevron are strong dividend players, backed by global scale, long-term reserves, and steady cash flows. Yet key differences emerge:

- Valuation: ExxonMobil is slightly cheaper based on P/E.

- Dividend Yield: ExxonMobil leads in yield, appealing to income seekers.

- Dividend Growth: Chevron has stronger recent growth rates.

- Sustainability: Chevron edges out with a safer payout ratio.

Final Verdict:

If you prioritize high current yield, ExxonMobil (XOM) is the better choice. But for long-term dividend growth with a more conservative payout, Chevron (CVX) takes the lead. For a balanced dividend portfolio, owning both could provide the best of both worlds.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always do your own research or consult a financial advisor before investing.

Leave a comment