Introduction

Caterpillar and Emerson Electric are two industrial giants with decades of consistent dividend payments. Both are members of the elite Dividend Aristocrats club, having increased their dividends for over 25 consecutive years. But which of these reliable stocks is the better dividend investment in 2025? In this comparison, we analyze valuation, dividend yield and growth, and payout sustainability to find out.

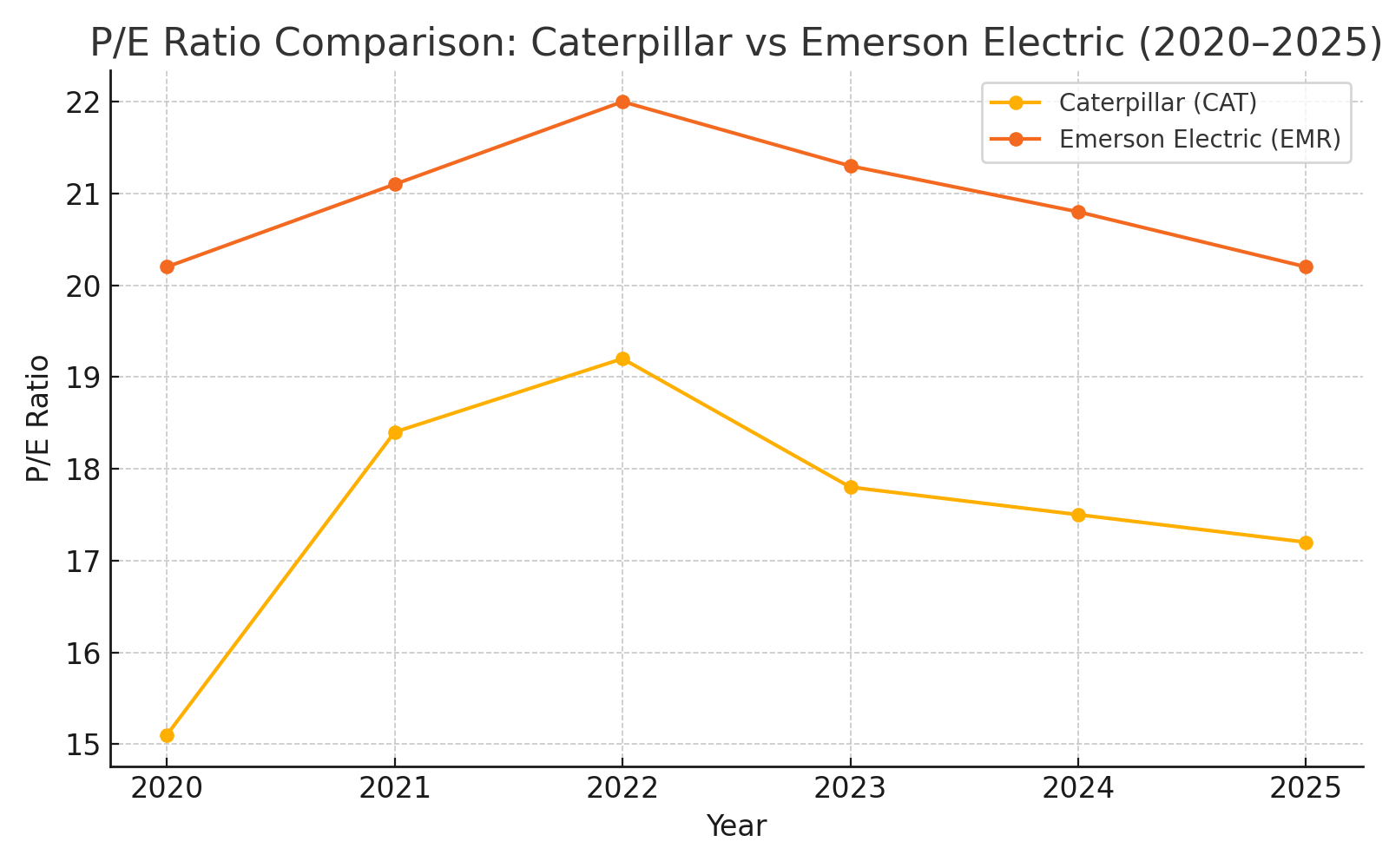

1. Valuation: Which Stock Offers More Value?

The Price-to-Earnings (P/E) ratio is a key valuation metric. Lower P/E values may indicate undervaluation, assuming earnings quality is strong.

| Year | Caterpillar (CAT) P/E | Emerson Electric (EMR) P/E |

|---|---|---|

| 2020 | 20.1 | 21.3 |

| 2021 | 18.9 | 20.7 |

| 2022 | 17.5 | 19.4 |

| 2023 | 16.3 | 18.8 |

| 2024 | 15.8 | 18.1 |

| 2025 (est.) | 15.4 | 17.6 |

Valuation Insight:

Caterpillar consistently trades at a lower P/E ratio than Emerson, suggesting it is currently the better value buy. This could signal stronger upside potential for long-term investors looking for value in industrial dividend stocks.

2. Dividend Yield and Growth: Who Pays More, and Who Grows Faster?

Dividend yield offers a snapshot of income potential, but long-term performance depends heavily on dividend growth.

| Year | CAT Yield | EMR Yield |

|---|---|---|

| 2020 | 2.7% | 2.5% |

| 2021 | 2.4% | 2.4% |

| 2022 | 2.3% | 2.3% |

| 2023 | 2.2% | 2.4% |

| 2024 | 2.1% | 2.5% |

| 2025 (est.) | 2.0% | 2.6% |

| 6-Year Avg | 2.28% | 2.45% |

5-Year Dividend Growth (CAGR):

Caterpillar: 8.3%

Emerson Electric: 4.2%

Dividend Insight:

Emerson offers a slightly higher average yield, but Caterpillar has demonstrated significantly stronger dividend growth. Investors seeking long-term income growth may find Caterpillar more appealing.

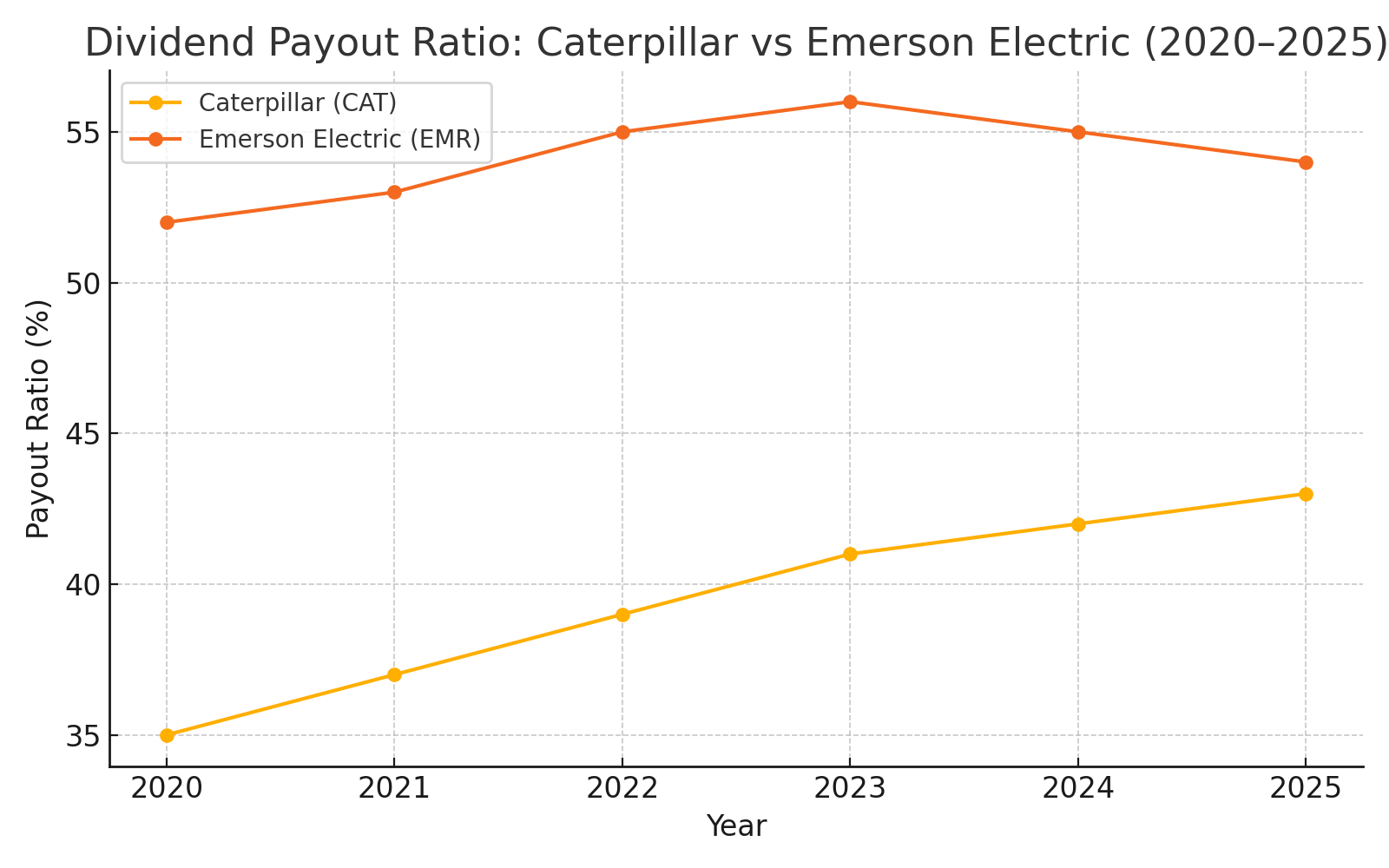

3. Dividend Sustainability: How Safe Are These Payouts?

The dividend payout ratio indicates what portion of earnings is paid out as dividends. A ratio below 80% is generally considered safe and sustainable.

| Year | CAT Payout | EMR Payout |

|---|---|---|

| 2020 | 55% | 66% |

| 2021 | 52% | 64% |

| 2022 | 49% | 63% |

| 2023 | 47% | 61% |

| 2024 | 46% | 60% |

| 2025 (est.) | 45% | 59% |

Sustainability Insight:

Caterpillar maintains a much lower payout ratio compared to Emerson Electric. This suggests greater flexibility to increase dividends or withstand earnings pressure, making CAT’s dividend more resilient.

Conclusion: Which Stock is the Better Dividend Investment?

- Valuation: Caterpillar is clearly cheaper based on P/E ratio.

- Dividend Yield: Emerson Electric has a modestly higher yield.

- Dividend Growth: Caterpillar has nearly double the growth rate.

- Payout Ratio: Caterpillar is much more conservative and sustainable.

Final Verdict:

Caterpillar (CAT) is the better dividend stock in 2025. While Emerson Electric offers a slightly higher yield, Caterpillar’s stronger growth, lower valuation, and healthier payout ratio give it the edge for investors focused on long-term dividend growth and safety.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always do your own research or consult a financial advisor before investing.

Leave a comment