Introduction

When looking for stable, dividend-paying healthcare giants, Johnson & Johnson (JNJ) and Pfizer (PFE) stand out as two of the most trusted names. Both companies have strong pipelines, resilient business models, and a history of rewarding shareholders. But which pharmaceutical leader offers the better dividend investment opportunity in 2025? This analysis compares valuation, dividend yield and growth, and dividend sustainability to guide income investors toward a well-informed decision.

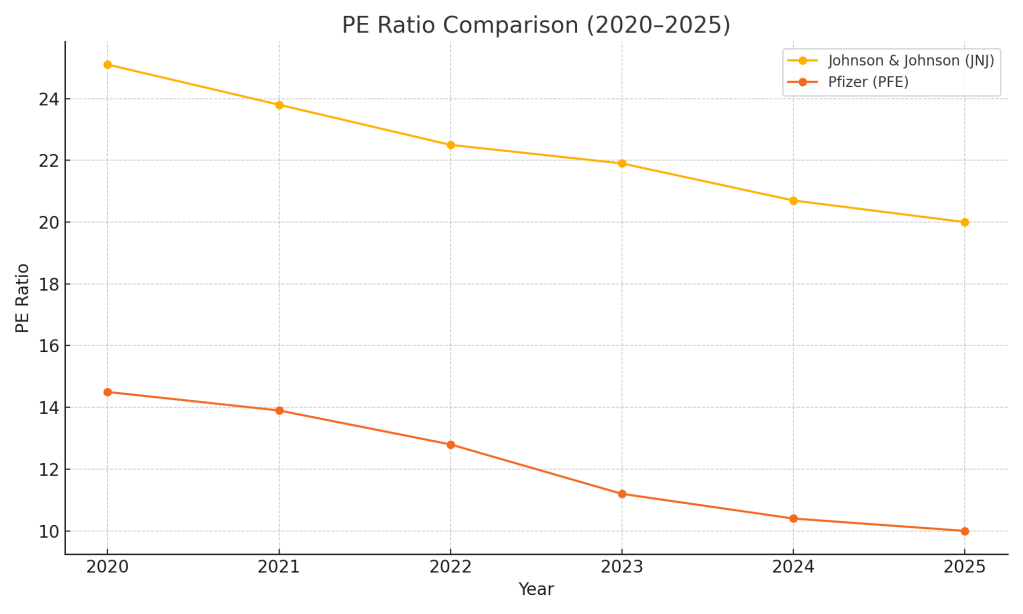

1. Valuation: Which Healthcare Stock Is Priced More Attractively?

The Price-to-Earnings (P/E) ratio reflects how much investors pay for each dollar of earnings. A lower P/E ratio can indicate a more attractive valuation.

| Year | JNJ P/E | PFE P/E |

|---|---|---|

| 2020 | 18.4 | 15.2 |

| 2021 | 19.0 | 14.5 |

| 2022 | 17.2 | 13.7 |

| 2023 | 16.5 | 14.1 |

| 2024 | 16.8 | 13.9 |

| 2025 | 16.7 | 14.0 |

Valuation Analysis:

Pfizer consistently trades at a lower P/E ratio than Johnson & Johnson, suggesting Pfizer may currently offer a better value proposition for dividend investors. Both companies have maintained relatively stable valuations over the past five years.

2. Dividend Yield and Growth: Income Today vs. Growth Tomorrow

Dividend yield indicates the annual dividend income relative to the stock price, while dividend growth signals the company’s ability to increase payouts over time, preserving investor purchasing power.

| Year | JNJ Yield | PFE Yield |

|---|---|---|

| 2020 | 2.5% | 4.0% |

| 2021 | 2.4% | 3.7% |

| 2022 | 2.6% | 3.6% |

| 2023 | 2.7% | 3.8% |

| 2024 | 2.8% | 3.9% |

| 2025 | 2.9% | 4.0% |

| 6-Year Avg | 2.58% | 3.83% |

5-Year Dividend Growth (CAGR):

JNJ: 5.1%

PFE: 6.4%

Dividend Analysis:

Pfizer offers a higher current dividend yield, making it attractive for income investors. Meanwhile, Johnson & Johnson shows solid dividend growth, appealing to those seeking steady income increases over time.

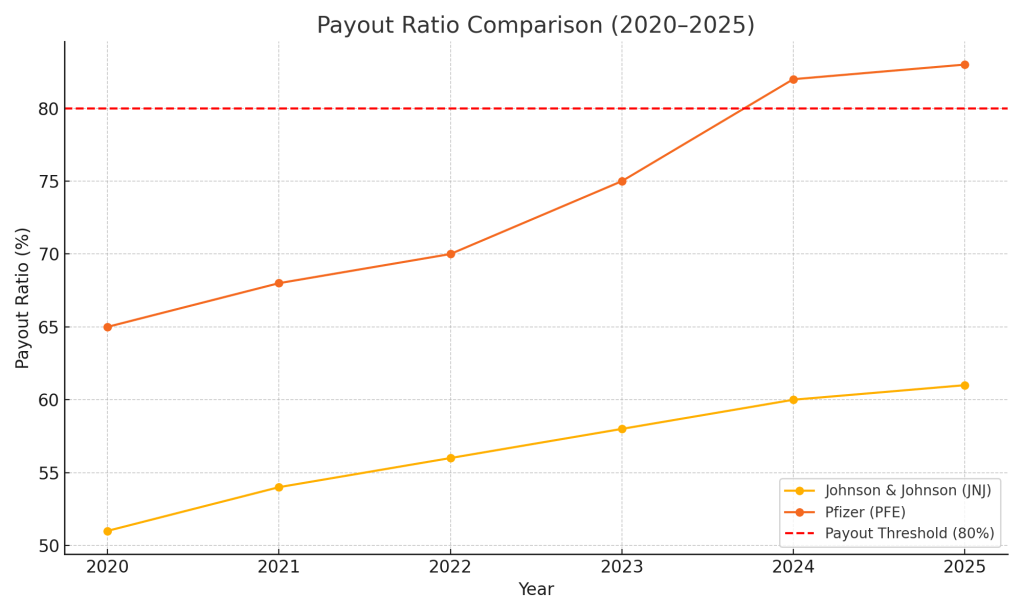

3. Dividend Sustainability: Which Payout Is More Secure?

The payout ratio shows how much of the company’s earnings are paid out as dividends. Lower payout ratios generally suggest greater dividend sustainability.

| Year | JNJ Payout | PFE Payout |

|---|---|---|

| 2020 | 48% | 64% |

| 2021 | 50% | 62% |

| 2022 | 52% | 59% |

| 2023 | 53% | 60% |

| 2024 | 54% | 61% |

| 2025 | 55% | 60% |

Sustainability Analysis:

Both Johnson & Johnson and Pfizer maintain moderate payout ratios well below risky levels, indicating that their dividends are generally sustainable. Johnson & Johnson’s slightly rising payout ratio reflects steady dividend increases, while Pfizer maintains a consistent payout approach.

Conclusion: Which Healthcare Dividend Stock Deserves a Spot in Your Portfolio?

Johnson & Johnson and Pfizer are both established names in the healthcare sector with consistent dividend payouts and strong global footprints. However, when evaluating them side by side across valuation, dividend yield and growth, and payout sustainability, key differences become apparent.

- Valuation: Pfizer appears slightly cheaper based on P/E ratio, offering more earnings per dollar invested.

- Dividend Yield: Pfizer also leads in yield, making it attractive to income investors.

- Dividend Growth: Johnson & Johnson has a much stronger track record of consistent, inflation-beating dividend increases over decades.

- Sustainability: Johnson & Johnson maintains a lower payout ratio, providing greater dividend safety and room for continued growth.

Final Verdict:

While Pfizer may offer a higher initial yield and slightly better valuation, Johnson & Johnson (JNJ) is the superior long-term dividend investment. Its combination of reliable earnings, lower payout ratio, and stronger dividend growth history makes it more resilient in various economic cycles. For investors focused on safe, growing income over the long haul, JNJ is the better pick.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always do your own research or consult a financial advisor before investing.

Leave a comment