Lowe’s and Home Depot are two giants in the U.S. home improvement retail sector. With consistent dividends and resilient business models, they attract dividend-focused investors looking for stable returns. This comparison evaluates which of the two is the better dividend stock in 2025 based on valuation, dividend performance, and sustainability.

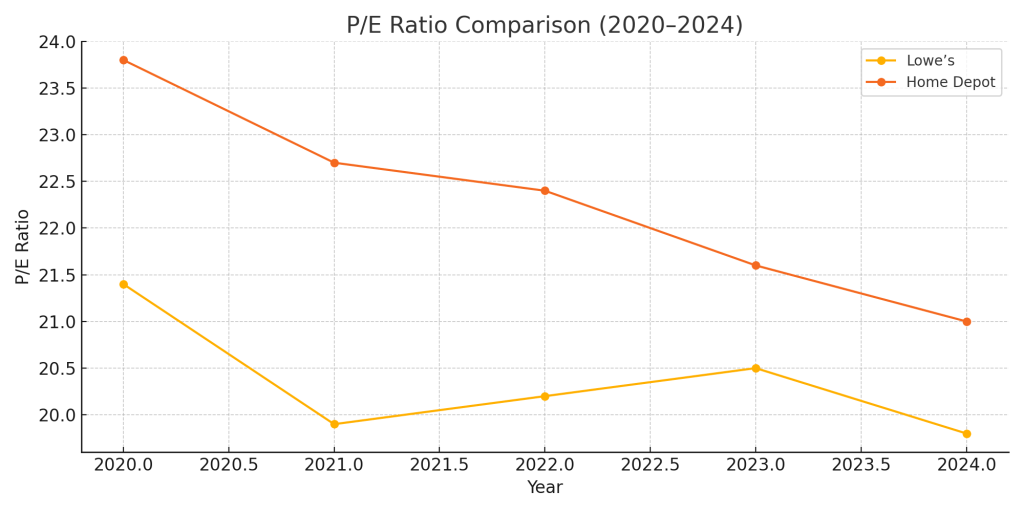

1. Valuation: Is Lowe’s or Home Depot Cheaper?

The Price-to-Earnings (P/E) ratio is a key metric that helps assess whether a stock is overvalued or undervalued compared to its earnings. A lower P/E ratio often signals a more attractive entry point for value investors.

| Year | Lowe’s P/E | Home Depot P/E |

|---|---|---|

| 2020 | 21.4 | 23.8 |

| 2021 | 19.9 | 22.7 |

| 2022 | 20.2 | 22.4 |

| 2023 | 20.5 | 21.6 |

| 2024 | 19.8 | 21.0 |

Valuation Analysis: Lowe’s currently trades at a slightly lower P/E ratio than Home Depot. While both stocks are within historical norms, Lowe’s appears to be the slightly more attractively priced stock in 2025.

2. Dividend Yield and Growth: Who Pays More and Increases Faster?

Dividend yield shows how much income an investor receives for each dollar invested. But equally important is the dividend growth rate, which reveals the company’s ability to increase payouts over time.

| Year | Lowe’s Yield | Home Depot Yield |

|---|---|---|

| 2020 | 1.9% | 2.4% |

| 2021 | 1.8% | 2.2% |

| 2022 | 1.9% | 2.3% |

| 2023 | 2.0% | 2.5% |

| 2024 | 2.1% | 2.6% |

5-Year Dividend CAGR:

Lowe’s: 16.1%

Home Depot: 11.3%

Dividend Analysis: Home Depot currently offers a higher dividend yield. However, Lowe’s has delivered significantly stronger dividend growth over the past five years, making it a better choice for long-term income compounding.

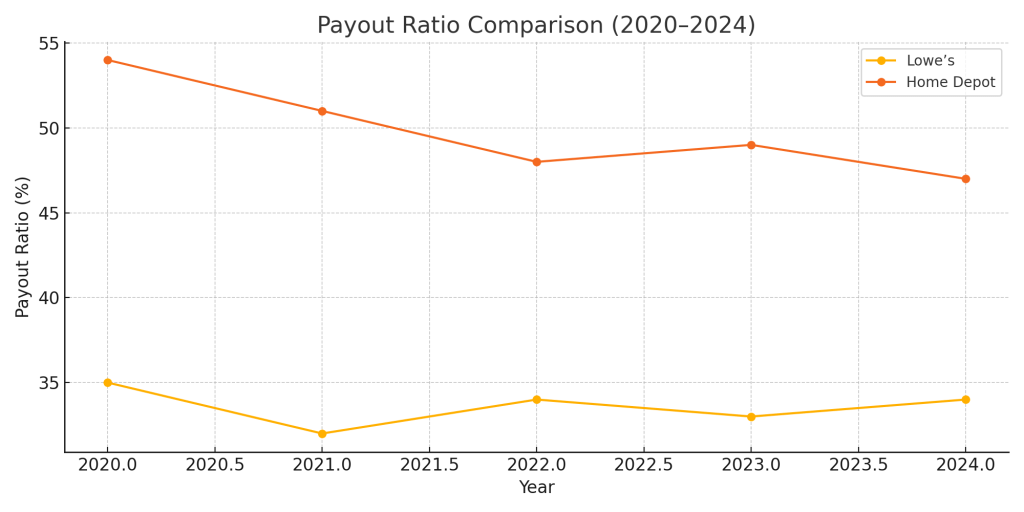

3. Dividend Sustainability: Are the Dividends Safe?

The payout ratio shows the percentage of net income paid out as dividends. A lower ratio often indicates better sustainability and room for dividend growth.

| Year | Lowe’s Payout Ratio | Home Depot Payout Ratio |

|---|---|---|

| 2020 | 35% | 54% |

| 2021 | 32% | 51% |

| 2022 | 34% | 48% |

| 2023 | 33% | 49% |

| 2024 | 34% | 47% |

Sustainability Analysis: Both companies have conservative payout ratios well below the 80% threshold. However, Lowe’s consistently operates with a much lower payout ratio, providing more flexibility for future dividend increases.

Conclusion: Which Dividend Stock Is the Better Buy in 2025?

Based on our dividend-focused investment criteria, both Lowe’s and Home Depot are strong contenders. But here’s how they compare:

- Valuation: Lowe’s is slightly cheaper based on P/E.

- Dividend Yield: Home Depot leads in current yield.

- Dividend Growth: Lowe’s outpaces Home Depot significantly.

- Dividend Sustainability: Lowe’s has a much lower payout ratio, indicating room for growth.

Final Verdict:

Lowe’s (LOW) stands out as the better dividend investment in 2025. Its stronger dividend growth, lower payout ratio, and slightly better valuation make it more attractive for long-term, income-oriented investors focused on compounding returns.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always do your own research or consult a financial advisor before investing.

Leave a comment