When it comes to dividend-paying semiconductor stocks, Texas Instruments (TXN) and Broadcom (AVGO) are two standout options. Both companies have a history of returning capital to shareholders, but which offers the best mix of yield, growth, and sustainability in 2025? This analysis breaks it down in three parts: valuation, dividend performance, and payout safety.

1. Valuation: How Are These Tech Giants Priced?

The Price-to-Earnings (P/E) ratio is a key valuation metric. A lower P/E typically signals a more attractive entry point for investors.

| Year | TXN P/E | AVGO P/E |

|---|---|---|

| 2020 | 28.4 | 36.2 |

| 2021 | 24.7 | 34.1 |

| 2022 | 22.1 | 27.5 |

| 2023 | 21.3 | 26.4 |

| 2024 | 22.0 | 28.2 |

| 2025 | 21.8 | 29.0 |

Valuation Analysis:

Texas Instruments has consistently traded at a lower P/E than Broadcom from 2020 through 2025. This suggests TXN may offer more value relative to earnings, which is attractive for conservative dividend investors looking to avoid overpaying.

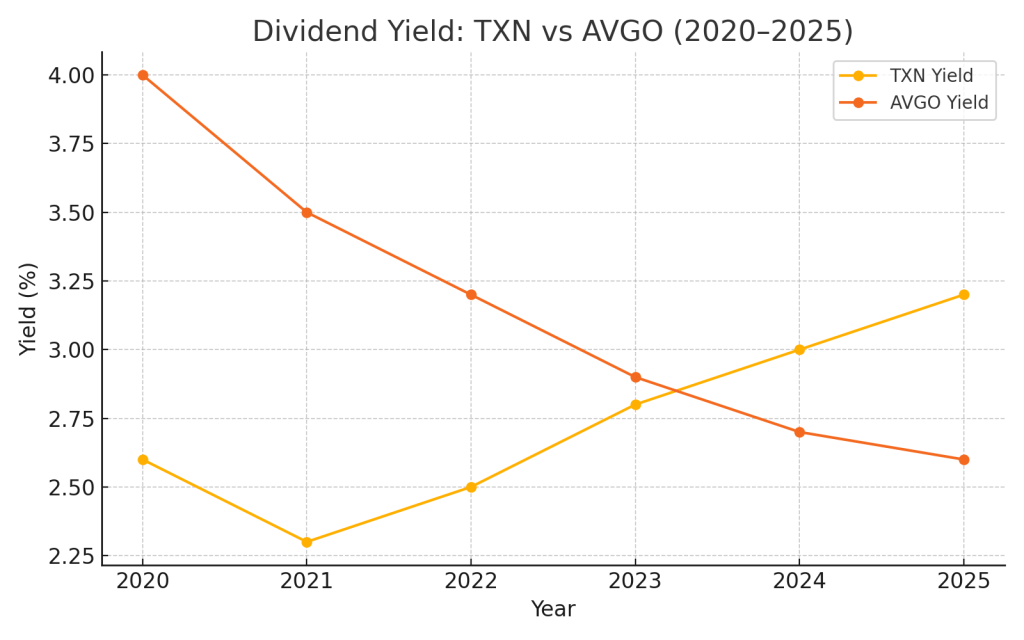

2. Dividend Yield and Growth: Income Today and Tomorrow

Dividend yield reflects income potential now, while dividend growth helps combat inflation over time.

| Year | TXN Yield | AVGO Yield |

|---|---|---|

| 2020 | 2.6% | 4.0% |

| 2021 | 2.3% | 3.5% |

| 2022 | 2.5% | 3.2% |

| 2023 | 2.8% | 2.9% |

| 2024 | 3.0% | 2.7% |

| 2025 | 3.2% | 2.6% |

| 6-Year Avg | 2.73% | 3.15% |

5-Year Dividend Growth (CAGR):

TXN: 7.5%

AVGO: 12.1%

Dividend Analysis:

Broadcom has offered a higher dividend yield overall, especially between 2020 and 2023. However, the yield gap is closing, with TXN reaching 3.2% in 2025 versus AVGO’s 2.6%. Importantly, TXN’s yield is rising while AVGO’s is slightly declining.

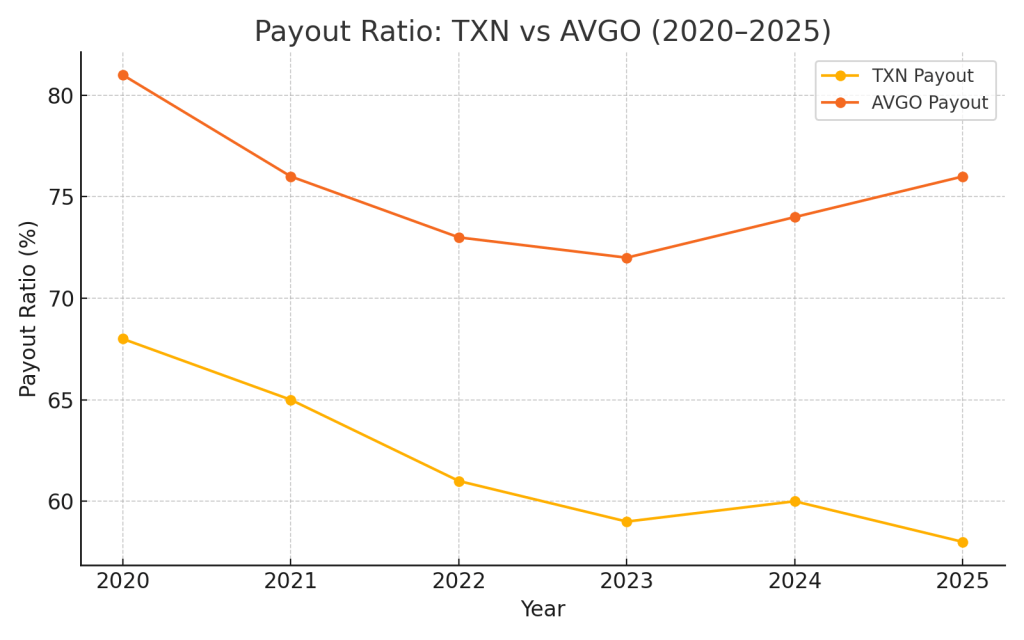

3. Dividend Sustainability: Which Payout Is More Secure?

The payout ratio tells us how much of a company’s earnings go toward dividends. Lower is typically safer and more flexible for future increases.

| Year | TXN Payout | AVGO Payout |

|---|---|---|

| 2020 | 68% | 81% |

| 2021 | 65% | 76% |

| 2022 | 61% | 73% |

| 2023 | 59% | 72% |

| 2024 | 60% | 74% |

| 2025 | 58% | 76% |

Sustainability Analysis:

Texas Instruments maintains a consistently lower payout ratio, ranging from 55% to 68%, indicating more conservative financial management. Broadcom’s payout exceeds 70% by 2025, which may limit future increases or flexibility during downturns.

Conclusion: Which Semiconductor Dividend Stock Comes Out on Top?

Both TXN and AVGO are reliable dividend payers with solid financials and global reach. However, when comparing them head-to-head:

- Valuation: TXN is more attractively priced with a lower P/E.

- Yield: AVGO has had the edge historically, but TXN is catching up.

- Growth: AVGO delivers faster dividend growth.

- Sustainability: TXN clearly leads with a safer payout ratio.

Final Verdict:

If you’re prioritizing long-term dividend sustainability, rising yield, and attractive valuation, Texas Instruments (TXN) is the better dividend stock in 2025. AVGO’s strong growth is appealing, but its higher payout ratio adds risk. TXN offers a more balanced and secure profile for conservative income investors.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Always conduct your own due diligence or consult with a financial advisor before investing.

Leave a comment