Microsoft and Apple are two of the most iconic technology companies in the world. While they are best known for innovation and growth, both are also reliable dividend payers. In this 2025 comparison, we analyze which of the two is the better dividend stock based on valuation, yield and growth, and payout sustainability. Do you want to see the comparison between techgiants Microsoft and Google, check it right here.

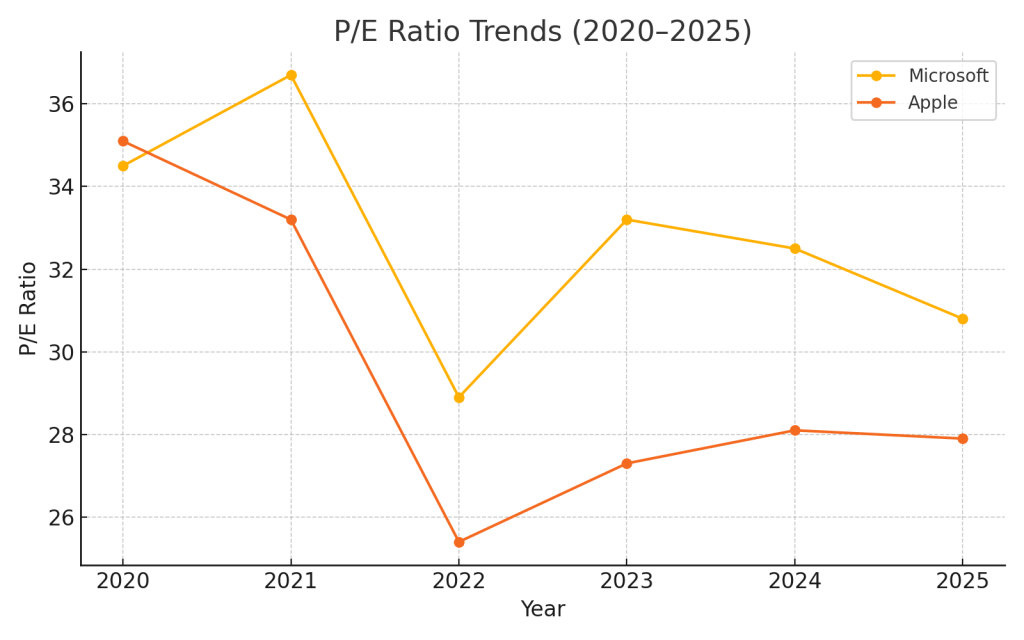

1. Valuation: Is Microsoft or Apple Cheaper?

The Price-to-Earnings (P/E) ratio offers a quick snapshot of valuation. A lower P/E ratio typically means better value, although growth expectations play a key role for tech stocks.

| Year | Microsoft P/E | Apple P/E |

|---|---|---|

| 2020 | 34.5 | 35.1 |

| 2021 | 36.7 | 33.2 |

| 2022 | 28.9 | 25.4 |

| 2023 | 33.2 | 27.3 |

| 2024 | 32.5 | 28.1 |

| 2025 | 30.8 | 27.9 |

Valuation Analysis: Apple consistently trades at a lower P/E ratio than Microsoft, indicating better valuation for long-term dividend investors in 2025.

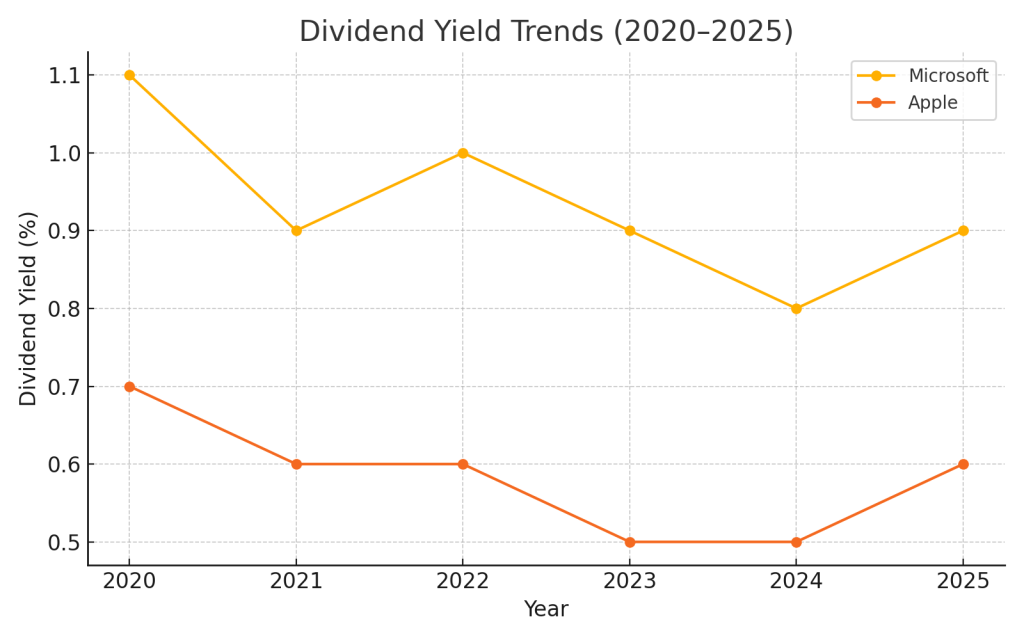

2. Dividend Yield and Growth: Who Pays More and Grows Faster?

Dividend yield tells you how much income you earn for every dollar invested. But the dividend growth rate reveals how fast that income may grow over time.

| Year | Microsoft Yield | Apple Yield |

|---|---|---|

| 2020 | 1.1% | 0.7% |

| 2021 | 0.9% | 0.6% |

| 2022 | 1.0% | 0.6% |

| 2023 | 0.9% | 0.5% |

| 2024 | 0.8% | 0.5% |

| 2025 | 0.9% | 0.6% |

5-Year Dividend CAGR:

Microsoft: 10.2%

Apple: 5.9%

Dividend Analysis: Microsoft offers a higher yield and much stronger dividend growth. This makes Microsoft a better option for compounding income over time.

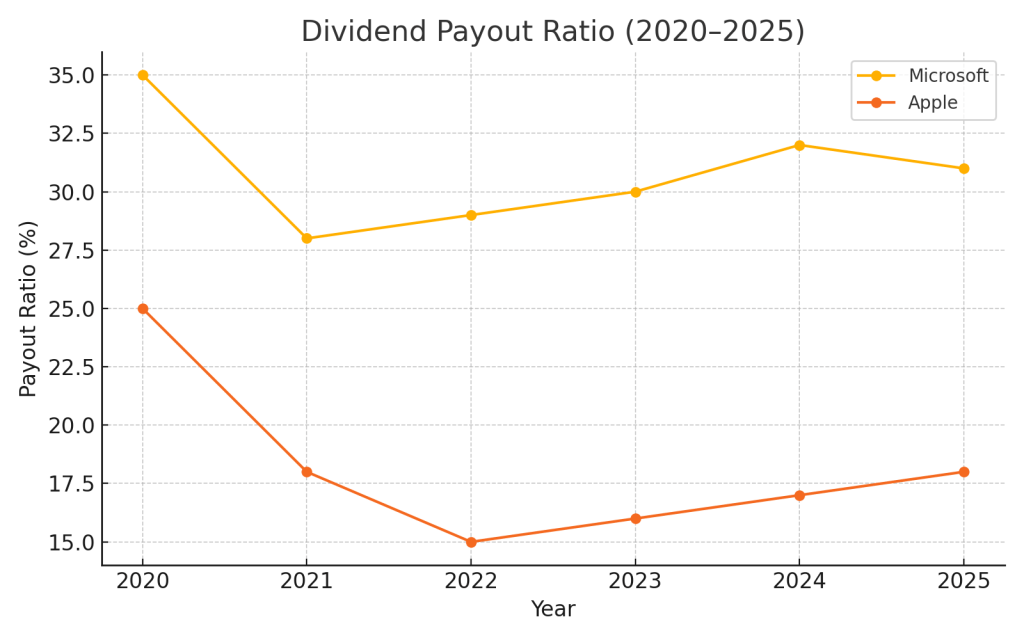

3. Dividend Sustainability: Are the Dividends Safe?

The payout ratio tells us how much of a company’s profit is paid out in dividends. A lower number usually means more room for future increases and greater dividend safety.

| Year | Microsoft Payout | Apple Payout |

|---|---|---|

| 2020 | 35% | 25% |

| 2021 | 28% | 18% |

| 2022 | 29% | 15% |

| 2023 | 30% | 16% |

| 2024 | 32% | 17% |

| 2025 | 31% | 18% |

Sustainability Analysis: Both companies have extremely safe payout ratios, but Apple’s is even more conservative. However, Microsoft still has ample room for future increases.

Conclusion: Which Dividend Stock Is the Better Buy in 2025?

Both Microsoft and Apple are financially strong and shareholder-friendly. But here’s how they compare on key dividend metrics:

- Valuation: Apple is cheaper based on P/E.

- Dividend Yield: Microsoft pays a higher dividend.

- Dividend Growth: Microsoft clearly leads in growth.

- Sustainability: Apple has a lower payout, but both are very safe.

Final Verdict:

Microsoft (MSFT) is the stronger dividend investment in 2025. While Apple is slightly cheaper, Microsoft’s superior dividend yield, faster growth, and still-conservative payout ratio make it a better choice for long-term income-focused investors.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always do your own research or consult a financial advisor before making investment decisions.

Leave a comment