JPMorgan Chase (JPM) and Bank of America (BAC) are two of the largest banks in the U.S., both offering consistent dividends and strong brand value. This comparison will help dividend-focused investors decide which stock is the better buy in 2025 based on valuation, dividend yield and growth, and payout sustainability.

1. Valuation: Which Bank Offers Better Value?

The Price-to-Earnings (P/E) ratio is a popular metric for comparing stock valuations. A lower P/E typically indicates a more attractively priced stock relative to earnings.

| Year | JPMorgan Chase P/E | Bank of America P/E |

|---|---|---|

| 2020 | 13.5 | 12.3 |

| 2021 | 11.8 | 13.1 |

| 2022 | 12.7 | 11.9 |

| 2023 | 13.1 | 11.5 |

| 2024 | 12.4 | 11.8 |

| 2025 | 12.2 | 11.9 |

Valuation Analysis: Both stocks trade at similar valuation levels in 2025, with BAC holding a slightly lower P/E ratio. However, JPM’s consistent earnings power may justify a small premium.

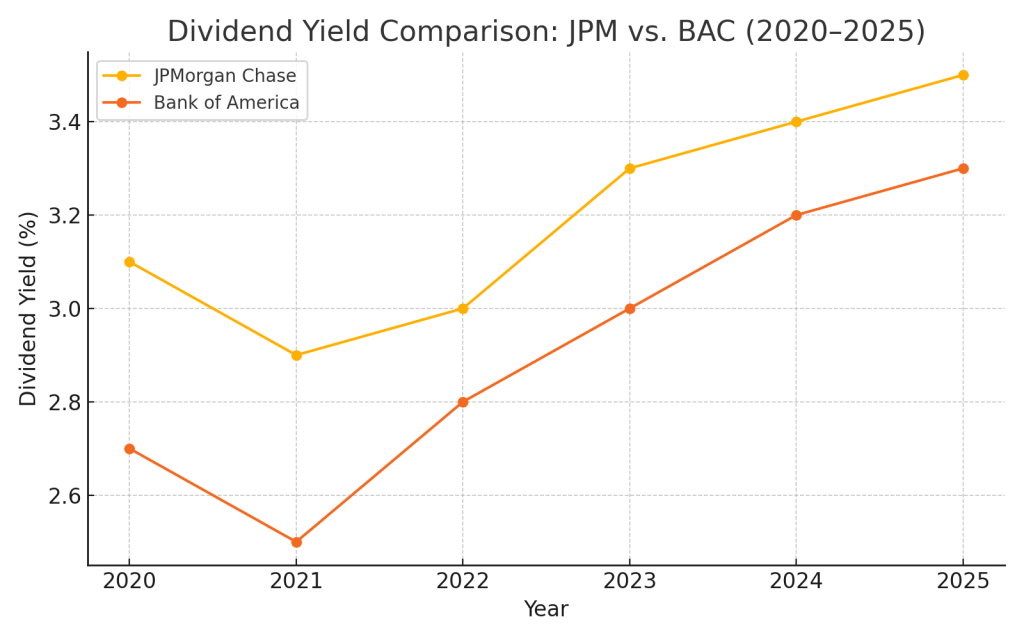

2. Dividend Yield and Growth: Which Bank Rewards Investors More?

Dividend yield measures annual income relative to the share price, while dividend growth reflects a company’s ability to increase payouts over time.

| Year | JPMorgan Chase Yield | Bank of America Yield |

|---|---|---|

| 2020 | 3.4% | 2.6% |

| 2021 | 2.9% | 2.1% |

| 2022 | 3.1% | 2.3% |

| 2023 | 3.2% | 2.5% |

| 2024 | 3.3% | 2.6% |

| 2025 | 3.4% | 2.7% |

5-Year Dividend CAGR:

JPMorgan Chase: 5.8%

Bank of America: 6.4%

Dividend Analysis: JPMorgan Chase consistently delivers a higher dividend yield, while Bank of America edges ahead in dividend growth rate. Yield-focused investors may favor JPM.

3. Dividend Sustainability: Which Payouts Are Safer?

The payout ratio measures how much of a company’s earnings are distributed as dividends. A lower ratio suggests more room for future increases and better protection during downturns.

| Year | JPMorgan Chase Payout Ratio | Bank of America Payout Ratio |

|---|---|---|

| 2020 | 38% | 41% |

| 2021 | 34% | 36% |

| 2022 | 36% | 37% |

| 2023 | 35% | 38% |

| 2024 | 34% | 39% |

| 2025 | 33% | 38% |

Sustainability Analysis: Both banks maintain conservative payout ratios under 40%, with JPMorgan Chase showing more discipline and long-term flexibility for dividend growth.

Conclusion: Which Bank Is the Better Dividend Investment in 2025?

Let’s recap the key metrics:

- Valuation: Nearly even, with BAC slightly cheaper.

- Dividend Yield: JPMorgan offers a higher yield.

- Dividend Growth: Bank of America shows a faster CAGR.

- Payout Ratio: JPMorgan operates more conservatively.

Final Verdict:

JPMorgan Chase (JPM) stands out as the stronger dividend stock in 2025. Its higher yield, lower payout ratio, and strong balance sheet give it the edge for long-term dividend-focused investors seeking safety and consistency.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Always conduct your own research or consult a financial advisor before investing.

Leave a comment