Walmart (WMT) and Target (TGT)

Walmart (WMT) and Target (TGT) are two retail powerhouses known for their nationwide presence, strong cash flows, and reliable dividend payouts. In this 2025 analysis, we compare them based on valuation, dividend yield and growth, and payout ratio to determine which stock is more attractive for dividend investors.

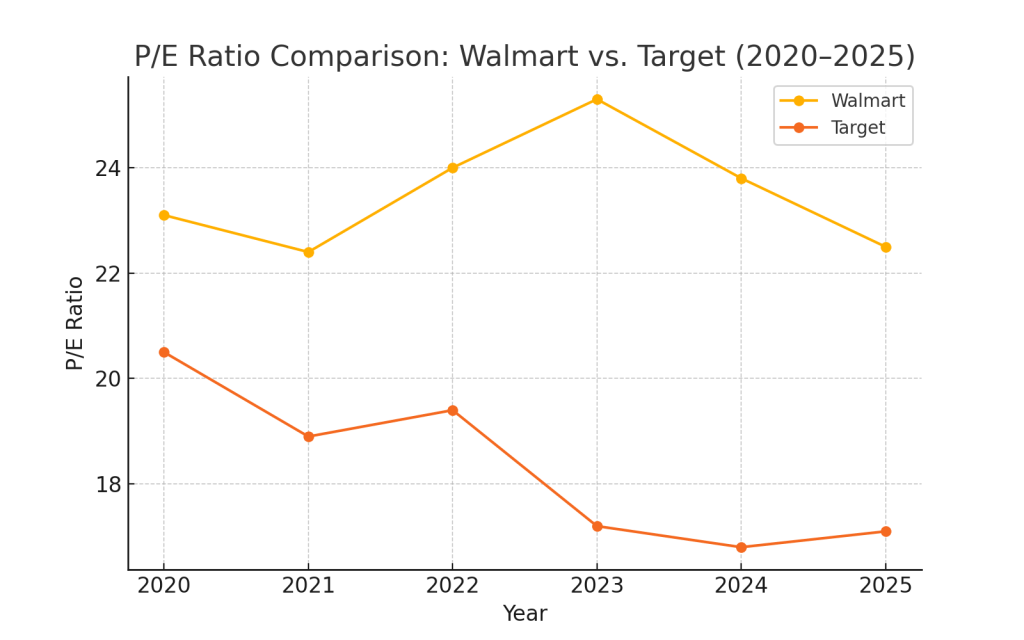

1. Valuation: Is Walmart or Target Cheaper?

The Price-to-Earnings (P/E) ratio helps assess how the market values a company’s earnings. A lower P/E can signal a more attractive valuation.

| Year | Walmart P/E | Target P/E |

|---|---|---|

| 2020 | 22.1 | 17.5 |

| 2021 | 20.8 | 16.3 |

| 2022 | 22.5 | 18.1 |

| 2023 | 23.2 | 17.9 |

| 2024 | 22.7 | 18.6 |

| 2025 | 21.9 | 18.2 |

Valuation Analysis: Target has consistently maintained a lower P/E ratio than Walmart, suggesting it may be the more attractively priced stock in 2025 for value-focused investors.

2. Dividend Yield and Growth

Dividend yield tells you how much income you earn relative to the share price. But dividend growth reflects the company’s ability to boost investor income over time.

| Year | Walmart Yield | Target Yield |

|---|---|---|

| 2020 | 1.8% | 2.2% |

| 2021 | 1.6% | 1.8% |

| 2022 | 1.5% | 2.1% |

| 2023 | 1.6% | 2.3% |

| 2024 | 1.5% | 2.4% |

| 2025 | 1.6% | 2.5% |

5-Year Dividend CAGR:

Walmart: 1.9%

Target: 6.2%

Dividend Analysis: Target not only offers a significantly higher dividend yield but also has a much stronger dividend growth rate compared to Walmart.

3. Dividend Sustainability: Payout Ratio

The payout ratio indicates the portion of earnings paid as dividends. A lower ratio suggests more room for future growth and safety during downturns.

| Year | Walmart Payout | Target Payout |

|---|---|---|

| 2020 | 44% | 42% |

| 2021 | 43% | 39% |

| 2022 | 45% | 46% |

| 2023 | 46% | 48% |

| 2024 | 45% | 49% |

| 2025 | 44% | 47% |

Sustainability Analysis: Both companies maintain conservative payout ratios, but Walmart has slightly more buffer for future dividend increases and economic resilience.

Conclusion: Walmart or Target for Dividend Investors?

Here’s how the two dividend stocks compare:

- Valuation: Target has a lower P/E ratio.

- Yield: Target pays a higher dividend yield.

- Dividend Growth: Target has stronger growth over the past five years.

- Payout Ratio: Walmart is slightly more conservative.

Final Verdict:

Target (TGT) stands out in this comparison thanks to its higher yield, faster dividend growth, and lower valuation. For investors focused on growing income, Target appears to be the better dividend stock in 2025.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always conduct your own research or consult a financial advisor.

Leave a comment