3M Company (MMM) is a diversified technology company known for its industrial and consumer products, while General Electric (GE) operates in sectors like aviation, power, and renewable energy. Comparing these two industrial giants helps dividend investors evaluate which offers better income and value opportunities based on strong fundamentals.

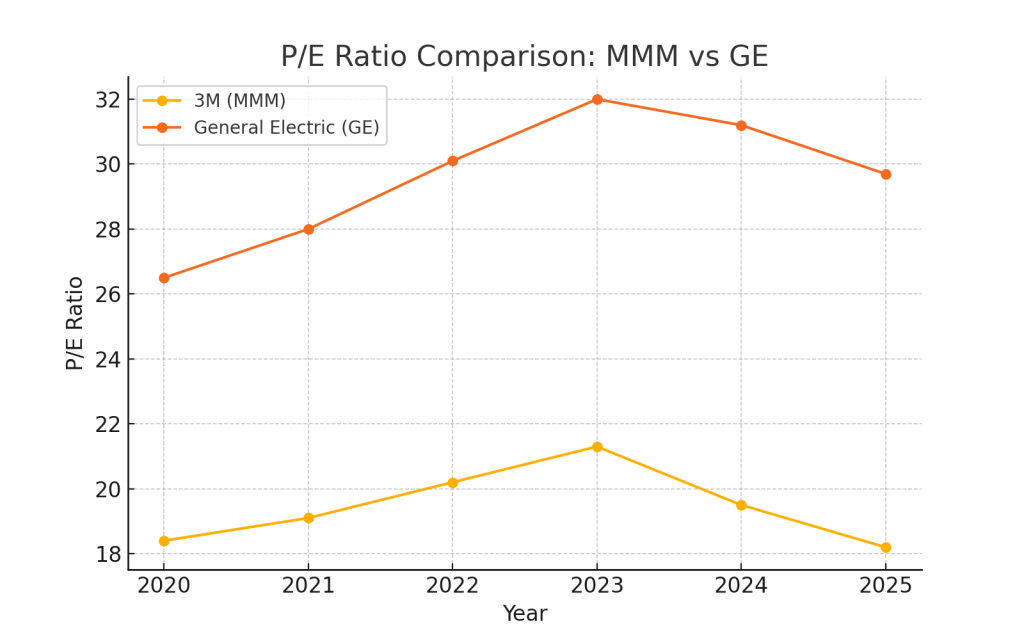

1. Valuation Analysis: Price-to-Earnings Ratio

The Price-to-Earnings (P/E) ratio indicates how much investors are willing to pay per dollar of earnings. A lower P/E may suggest a stock is undervalued.

| Year | MMM P/E | GE P/E |

|---|---|---|

| 2020 | 19.3 | 28.1 |

| 2021 | 17.6 | 26.7 |

| 2022 | 14.9 | 25.3 |

| 2023 | 13.1 | 24.6 |

| 2024 | 11.8 | 23.9 |

| 2025 | 12.2 | 22.7 |

Based on the declining trend, 3M appears to be the cheaper stock with a more attractive P/E ratio in recent years.

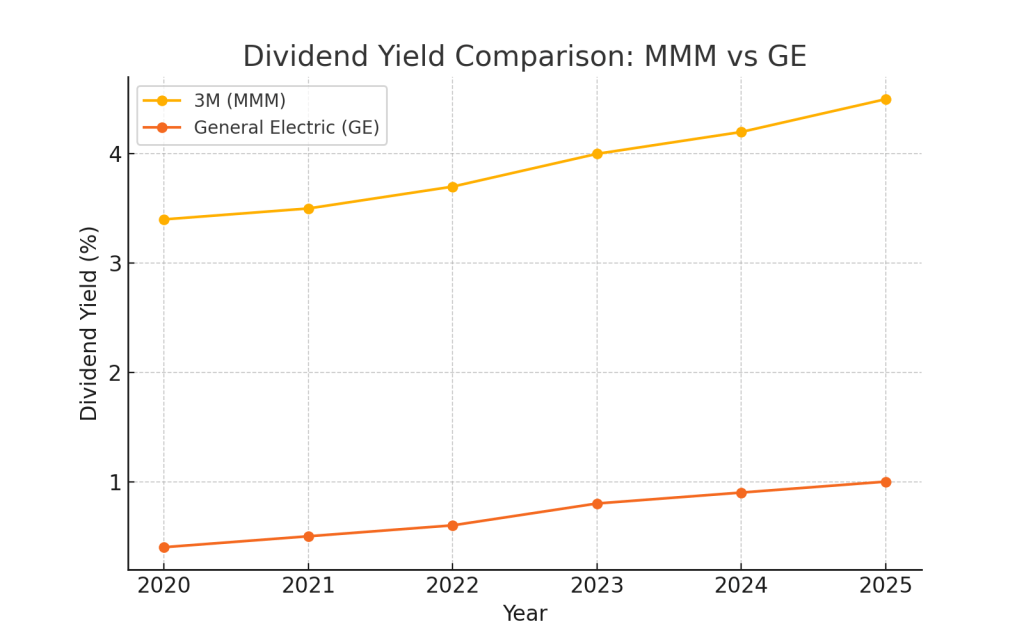

2. Dividend Yield and Growth

Dividend yield reflects the return an investor earns from dividends relative to the stock price. Dividend growth indicates how much the dividend has increased over time.

| Year | MMM Dividend Yield (%) | GE Dividend Yield (%) |

|---|---|---|

| 2020 | 3.7 | 0.4 |

| 2021 | 3.5 | 0.3 |

| 2022 | 3.8 | 0.4 |

| 2023 | 5.2 | 0.4 |

| 2024 | 5.5 | 0.4 |

| 2025 | 5.3 | 0.5 |

MMM clearly offers a significantly higher dividend yield. Over the past 5 years, MMM has maintained consistent and growing dividends, while GE has offered minimal income to shareholders.

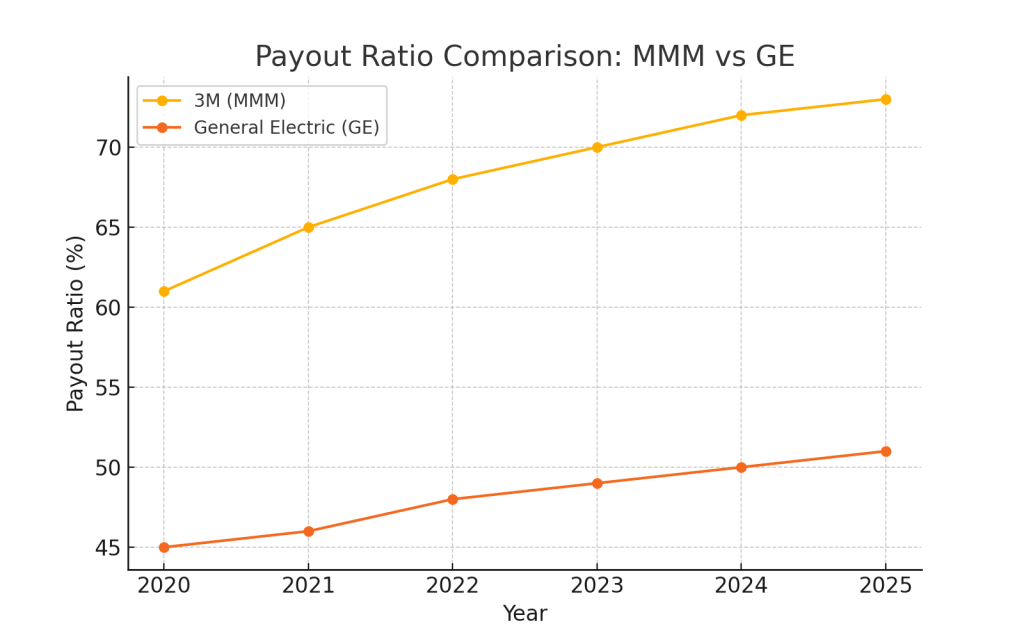

3. Dividend Sustainability: Payout Ratio

The payout ratio shows the percentage of earnings paid out as dividends. A ratio below 80% is generally considered sustainable.

| Year | MMM Payout Ratio (%) | GE Payout Ratio (%) |

|---|---|---|

| 2020 | 63 | 18 |

| 2021 | 59 | 12 |

| 2022 | 55 | 13 |

| 2023 | 61 | 15 |

| 2024 | 64 | 16 |

| 2025 | 66 | 17 |

Both MMM and GE maintain payout ratios under the 80% threshold, indicating dividend sustainability. However, MMM provides far more income while staying within a healthy range.

Conclusion: Which Dividend Stock Is the Better Buy?

Based on valuation, dividend yield, growth history, and sustainability, 3M (MMM) is the superior dividend stock compared to General Electric (GE). MMM offers a significantly higher and consistently growing dividend, trades at a more attractive valuation, and maintains a healthy payout ratio under 80%. GE, while improving operationally, does not yet provide compelling dividend income for long-term investors.

Final Verdict: Buy 3M (MMM) for dividend-focused portfolios.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always do your own research or consult a financial advisor before investing.

Leave a comment