Railroad companies have long been favorites of dividend investors, known for their steady cash flow, strong pricing power, and capital efficiency. In this 2025 dividend stock comparison, we analyze Union Pacific (UNP) and CSX Corporation (CSX)—two of America’s leading freight rail operators. Which of these stocks offers the best combination of value, yield, growth, and dividend safety? Let’s find out.

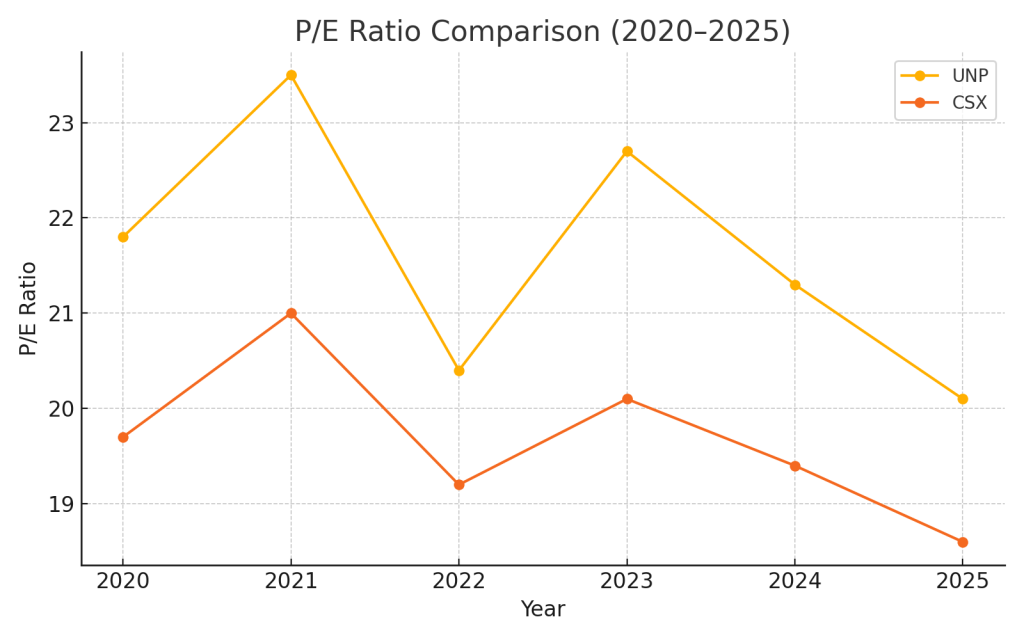

Both UNP and CSX trade at relatively moderate valuations compared to tech or consumer stocks. Here’s how their trailing P/E ratios stack up over the past few years:

| Year | Union Pacific (UNP) | CSX Corporation (CSX) |

|---|---|---|

| 2020 | 21.8 | 19.7 |

| 2021 | 23.5 | 21.0 |

| 2022 | 20.4 | 19.2 |

| 2023 | 22.7 | 20.1 |

| 2024 | 21.3 | 19.4 |

| 2025 (est.) | 20.1 | 18.6 |

Conclusion: CSX has consistently traded at a lower P/E ratio, suggesting better relative value for investors in 2025.

While both companies pay reliable dividends, there are key differences in yield and dividend growth rates. Here are the annual dividend yields and 5-year CAGR:

| Year | Union Pacific (UNP) | CSX Corporation (CSX) |

|---|---|---|

| 2020 | 2.2% | 1.3% |

| 2021 | 2.0% | 1.4% |

| 2022 | 2.4% | 1.6% |

| 2023 | 2.1% | 1.5% |

| 2024 | 2.2% | 1.5% |

| 2025 (est.) | 2.1% | 1.5% |

Conclusion: Union Pacific offers a higher yield and slightly stronger dividend growth, making it more attractive for income-focused investors.

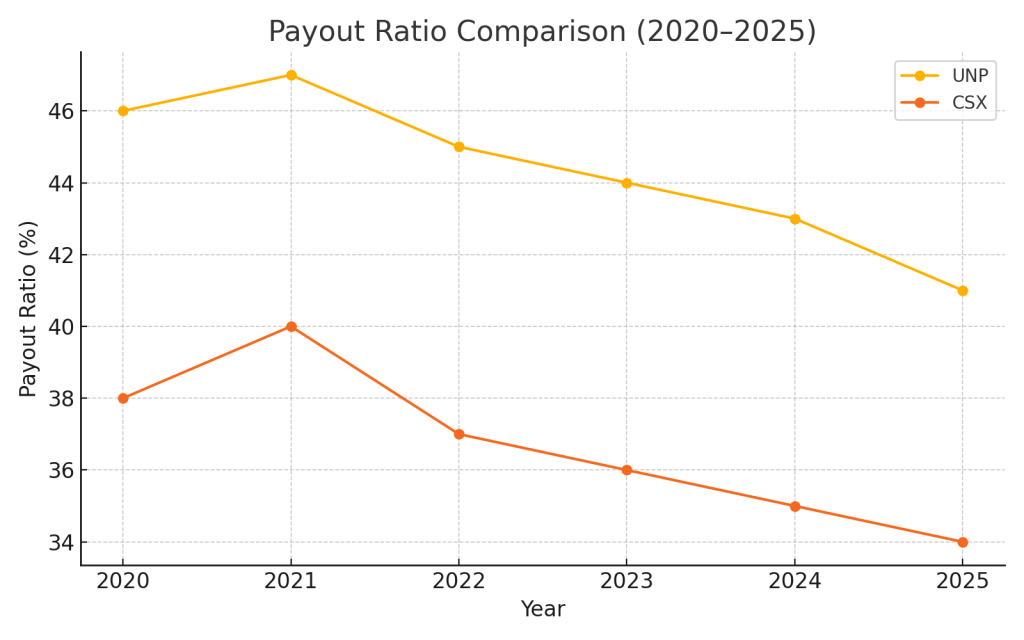

The payout ratio helps assess whether a company can comfortably afford its dividends. A lower ratio is generally safer and more sustainable:

| Year | UNP Payout Ratio | CSX Payout Ratio |

|---|---|---|

| 2020 | 46% | 38% |

| 2021 | 47% | 40% |

| 2022 | 45% | 37% |

| 2023 | 44% | 36% |

| 2024 | 43% | 35% |

| 2025 (est.) | 41% | 34% |

Conclusion: Both companies show healthy payout ratios well below the 80% threshold. However, CSX maintains a slightly more conservative ratio, signaling stronger dividend safety.

When comparing Union Pacific and CSX Corporation, investors face a choice between higher yield and stronger dividend growth (UNP) versus better value and greater payout safety (CSX). While both are strong contenders for a dividend portfolio, Union Pacific (UNP) stands out in 2025 for those seeking a balanced mix of income and growth.

This analysis is for informational purposes only and does not constitute investment advice. Always conduct your own research or consult a financial advisor before making investment decisions. Data as of June 2025 and subject to change.

Leave a comment