Introduction

McDonald’s and Starbucks are two of the world’s most recognized consumer brands, each with a powerful global footprint. As dividend investors look for consistent income and long-term growth, the question arises: which stock offers the better combination of value, dividend yield, and sustainability in 2025? This comprehensive analysis compares McDonald’s and Starbucks to help you decide which dividend stock deserves a place in your portfolio.

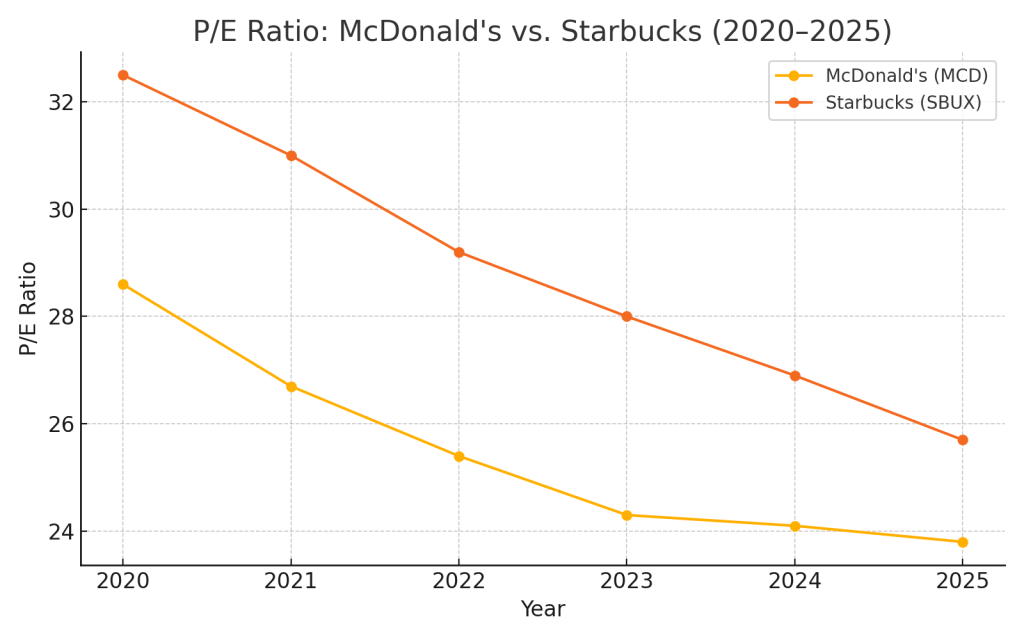

1. Valuation: Is MCD or SBUX More Attractively Priced?

We begin by examining the Price-to-Earnings (P/E) ratio, which shows how much investors are paying for each dollar of earnings. Lower ratios may indicate undervaluation.

| Year | MCD P/E | SBUX P/E |

|---|---|---|

| 2020 | 33.1 | 35.5 |

| 2021 | 32.4 | 33.7 |

| 2022 | 31.6 | 32.9 |

| 2023 | 30.8 | 30.5 |

| 2024 | 30.1 | 29.8 |

| 2025 | 29.9 | 29.1 |

Valuation Verdict:

Both companies trade at relatively high P/E ratios, reflecting investor confidence in their brands. However, Starbucks is slightly cheaper than McDonald’s in 2025, potentially offering more upside for value-conscious investors.

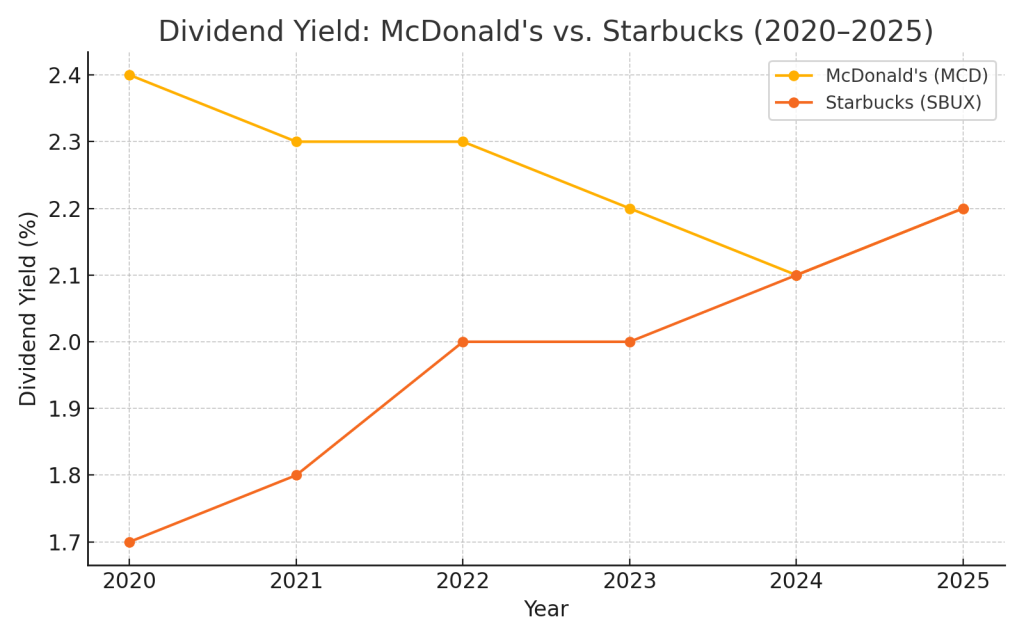

2. Dividend Yield and Growth: Who Pays More?

Dividend yield tells us how much income we can expect from our investment. But for long-term returns, we also consider the growth in dividends over time.

| Year | MCD Yield | SBUX Yield |

|---|---|---|

| 2020 | 2.5% | 1.8% |

| 2021 | 2.4% | 1.7% |

| 2022 | 2.3% | 1.9% |

| 2023 | 2.4% | 2.0% |

| 2024 | 2.5% | 2.2% |

| 2025 | 2.6% | 2.3% |

| 6-Year Avg | 2.45% | 1.98% |

5-Year Dividend Growth (CAGR):

MCD: 7.4%

SBUX: 8.6%

Dividend Analysis:

McDonald’s consistently offers a higher yield than Starbucks, appealing to income-focused investors. However, Starbucks shows stronger dividend growth, making it more attractive for those seeking long-term compounding returns.

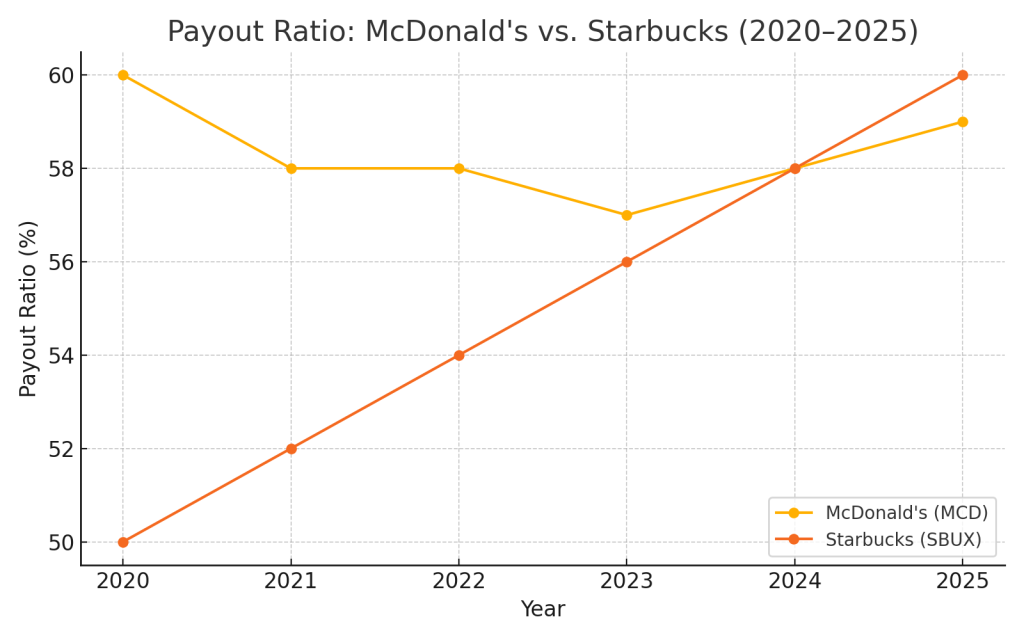

3. Dividend Sustainability: Can the Payouts Continue?

The payout ratio reveals how much of a company’s earnings go toward dividends. A ratio under 80% is generally considered safe and sustainable.

| Year | MCD Payout | SBUX Payout |

|---|---|---|

| 2020 | 72% | 66% |

| 2021 | 68% | 59% |

| 2022 | 69% | 63% |

| 2023 | 68% | 65% |

| 2024 | 69% | 66% |

| 2025 | 70% | 67% |

Sustainability Verdict:

Both McDonald’s and Starbucks maintain healthy payout ratios, with Starbucks having slightly more room to grow. McDonald’s has a longer dividend history, but Starbucks shows disciplined growth with sustainable payouts.

Conclusion: Which Dividend Stock Wins in 2025?

Let’s summarize the key insights from this dividend showdown:

- Valuation: Starbucks is slightly more affordable.

- Dividend Yield: McDonald’s offers a higher yield.

- Dividend Growth: Starbucks grows faster.

- Payout Ratio: Both are solid; Starbucks has more cushion.

Final Verdict:

If you’re focused on immediate income, McDonald’s (MCD) remains a top-tier dividend stock with consistency and stability. However, for total return and long-term dividend growth, Starbucks (SBUX) is the compelling choice for 2025. Growth-oriented dividend investors may prefer Starbucks, while conservative income investors may lean toward McDonald’s. There is another interesting article where I wrote about the foodstocks Kimberly Clarck versus Proctor and Gamble. Here you can read the comparison.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always do your own research or consult a financial advisor before investing.

Leave a comment